The trend of women investing in real estate has seen significant growth over the years. Financial independence, changing societal norms, and various government incentives have contributed to this increase. Women today view homeownership not just as a means of security but also as an essential financial asset that ensures long-term wealth creation. Governments and financial institutions have recognized this shift and are offering several benefits to encourage women homebuyers. This document explores the trends among women homebuyers and the various government incentives designed to facilitate their homeownership journey.

Trends Among Women Homebuyers

1. Increasing Participation in Real Estate

Traditionally, real estate investments were dominated by men. However, over the past decade, the number of women purchasing homes has risen significantly. Women now account for a substantial percentage of homebuyers, particularly in urban areas. Factors contributing to this trend include greater workforce participation, higher disposable incomes, and a growing preference for financial independence.

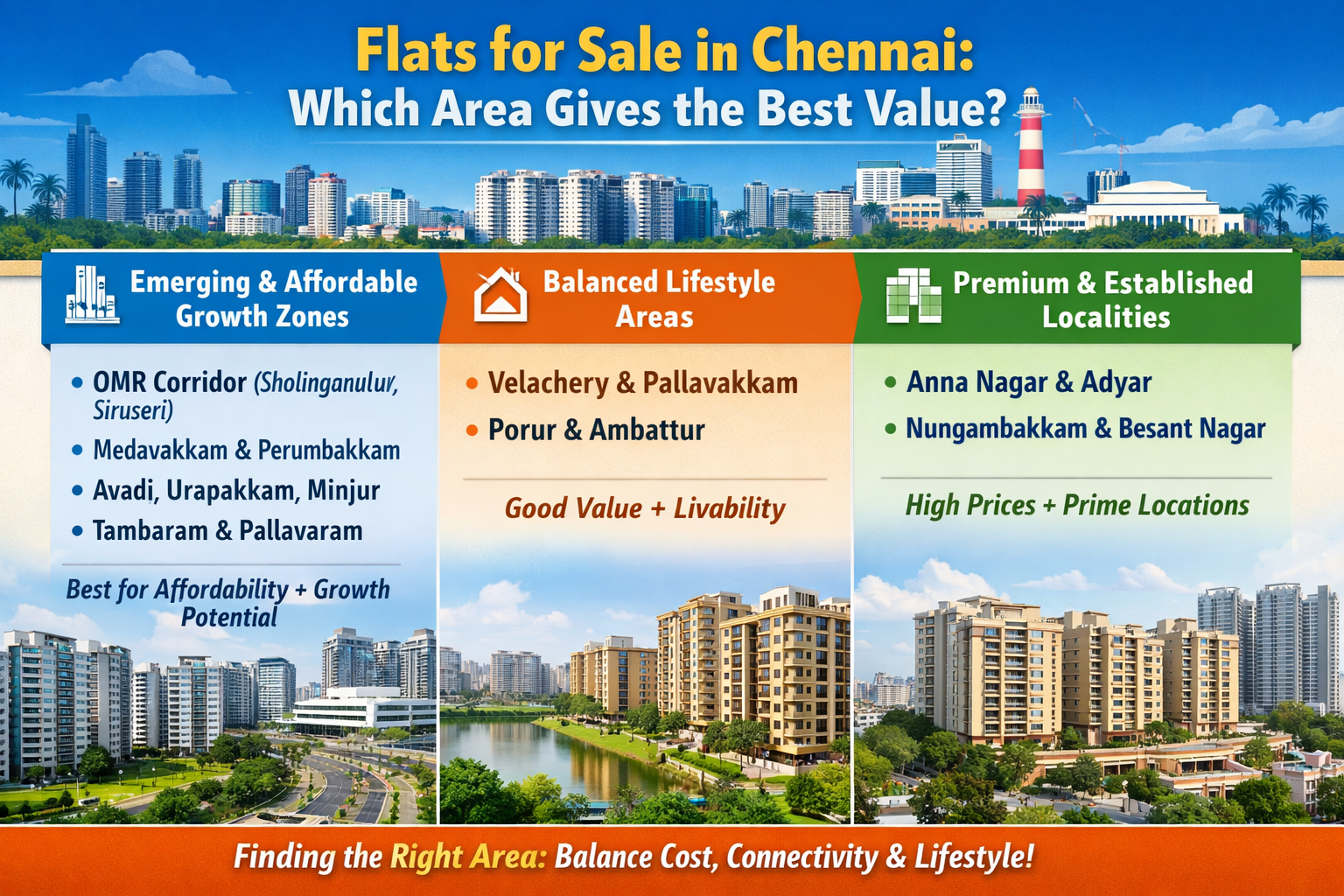

2. Preference for Secure and Well-Connected Locations

Security remains a crucial factor influencing women’s homebuying decisions. Many women prefer gated communities or locations with good security infrastructure. Additionally, proximity to essential amenities such as schools, hospitals, shopping centers, and workplaces plays a significant role in their choices.

3. Investment and Wealth Creation Perspective

Women are increasingly considering real estate as a long-term investment option rather than just a necessity. Many purchase homes as an asset that can generate rental income and appreciate in value over time. This shift in mindset has led to a rise in single women purchasing homes for investment purposes.

4. Growing Number of Single Women Homebuyers

A notable trend is the rise in the number of single women investing in property. Unlike earlier times when homeownership was primarily associated with married couples, single working women now view property investment as a crucial financial milestone. This change is driven by career advancements, financial literacy, and the need for personal stability.

5. Preference for Joint Ownership

While many women purchase homes independently, a significant number opt for joint ownership with their spouses. Joint ownership provides financial security, improves loan eligibility, and offers various tax benefits, making it an attractive option for couples.

| "BEST BUILDER FLOOR APARTMENT IN CHENNAI" |

Government Incentives for Women Homebuyers

Governments at both the central and state levels have introduced several incentives to encourage women to invest in real estate. These incentives range from lower stamp duty charges to tax benefits and priority in affordable housing schemes.

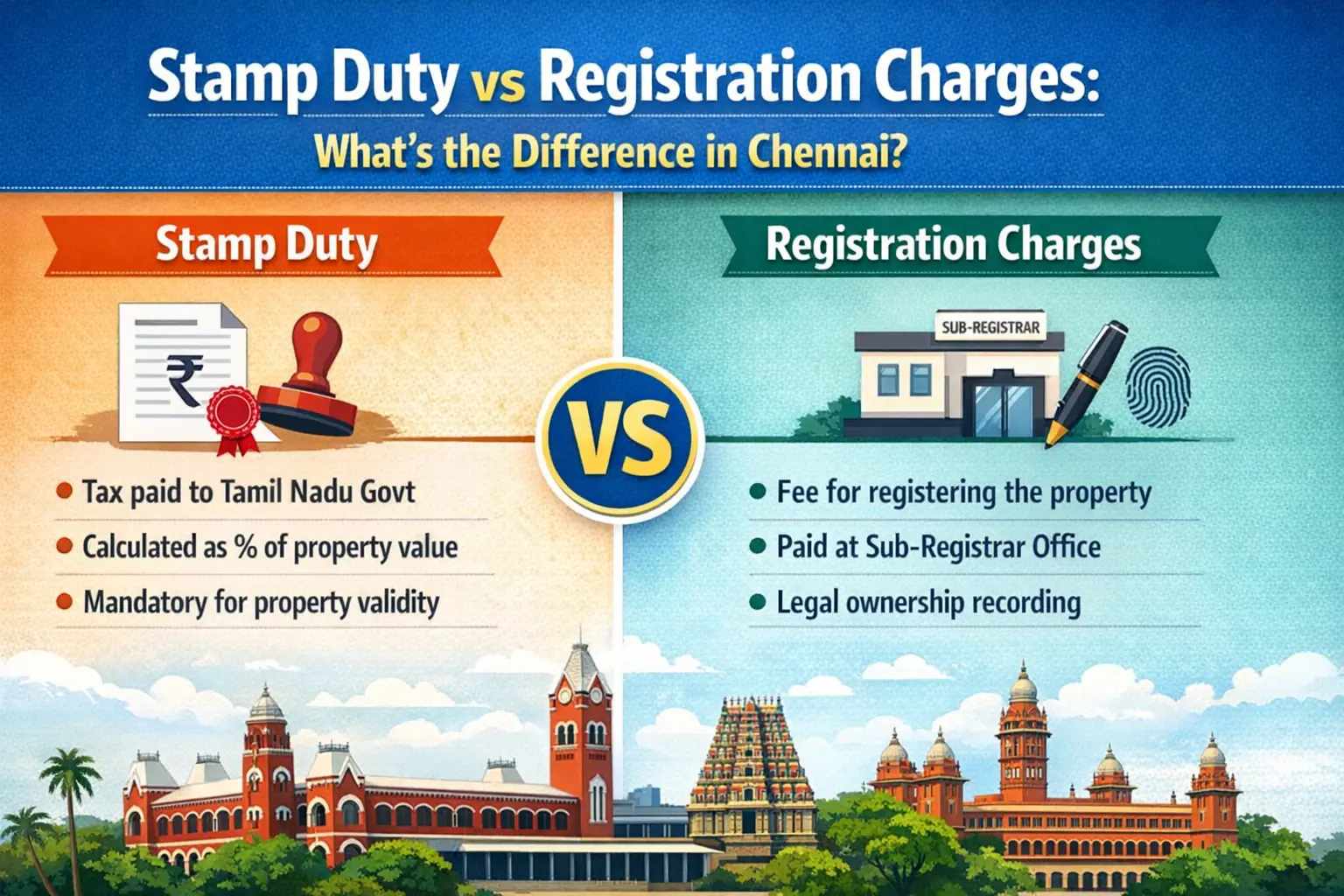

1. Lower Stamp Duty Charges

Many state governments in India offer lower stamp duty rates for women homebuyers compared to men. Stamp duty is a significant cost component in property transactions, and this concession helps reduce the overall financial burden on women buyers.

-

Delhi: Women pay 4% stamp duty compared to 6% for men.

-

Haryana: Stamp duty is 5% for women and 7% for men.

-

Uttar Pradesh: Women pay 6% stamp duty, while men pay 7%.

-

Maharashtra: Women homebuyers get a 1% rebate on stamp duty.

Also Read: Stamp Duty and Property Registration Charges Chennai 2024

2. Pradhan Mantri Awas Yojana (PMAY)

The Pradhan Mantri Awas Yojana (PMAY) is a government initiative aimed at providing affordable housing to all. Under this scheme, women, especially those from economically weaker sections (EWS) and low-income groups (LIG), are given priority.

-

Women applicants receive preference in the allocation of affordable homes.

-

The scheme mandates that at least one female member should be the owner or co-owner of the house.

-

Women can avail of an interest subsidy of up to ?2.67 lakh on home loans under the Credit Linked Subsidy Scheme (CLSS).

3. Lower Home Loan Interest Rates

Many banks and financial institutions offer lower home loan interest rates for women. This helps in reducing the overall cost of homeownership and encourages women to invest in real estate.

-

Most banks provide a 0.05% to 0.1% concession in interest rates for women borrowers.

-

Leading banks such as State Bank of India (SBI), HDFC, and ICICI offer special home loan schemes for women.

-

Lower interest rates result in lower EMI payments, making homeownership more affordable.

4. Tax Benefits for Women Homebuyers

Women homebuyers can avail of several tax benefits that help in reducing their overall financial burden:

-

Under Section 24(b) of the Income Tax Act, women can claim a tax deduction of up to ?2 lakh on home loan interest.

-

Under Section 80C, women can claim an additional deduction of ?1.5 lakh on the principal repayment of the home loan.

-

If the house is jointly owned, both spouses can claim tax deductions separately, effectively doubling the tax benefits.

5. Special Housing Schemes by State Governments

Several state governments have introduced special schemes to promote homeownership among women. These include:

-

Punjab: The state government offers financial aid and subsidies for women purchasing homes under affordable housing projects.

-

Rajasthan: The government provides additional incentives and relaxations for women first-time homebuyers.

-

Tamil Nadu: Women-led households receive priority in government-sponsored housing schemes.

The increasing participation of women in the real estate sector is a positive trend, driven by financial independence, economic empowerment, and favorable government policies. Various incentives such as lower stamp duty, reduced home loan interest rates, tax benefits, and special housing schemes make homeownership more accessible for women. As awareness grows and more women take charge of their financial decisions, this trend is expected to continue, further strengthening their role in the real estate market.

Encouraging women to invest in property not only enhances their financial security but also contributes to economic growth and gender equality in asset ownership. With continued support from the government and financial institutions, the future looks promising for women homebuyers.

https://www.livehomes.in/blogs