Buying a builder floor apartment in Chennai can be a great investment, offering more privacy and independence than traditional high-rise apartments. However, there are several pitfalls that buyers should be aware of to avoid financial loss and legal complications. Here’s a detailed guide on common mistakes to avoid when purchasing a builder floor apartment in Chennai:

1. Not Verifying Legal Approvals & Documents

Many builder floor apartments in Chennai are built on small plots where approvals and regulations may not be strictly followed.

What to Check?

-

Title Deed – Ensure the seller has clear ownership of the land.

-

Patta & Encumbrance Certificate (EC) – Verify that there are no legal disputes or loans on the property.

-

Building Plan Approval – Confirm that the Chennai Metropolitan Development Authority (CMDA) or Greater Chennai Corporation (GCC) has approved the plan.

-

Completion Certificate (CC) & Occupancy Certificate (OC) – Check if the builder has obtained these before possession.

-

RERA Registration – If the project has more than 8 units or covers more than 500 sq. m., it must be registered under Tamil Nadu RERA (TNRERA).

2. Ignoring the UDS (Undivided Share of Land)

What is UDS?

-

It represents your share of the land on which the building is constructed.

-

A low UDS value means less ownership of the land, reducing resale value.

What to Check?

-

Ensure your UDS is at least 50-60% of the apartment’s built-up area.

-

Clarify UDS distribution among all flat owners.

3. Not Checking the Construction Quality

Builder floor apartments are often constructed in smaller plots where quality standards may vary.

What to Check?

-

Type of Materials Used – Inspect tiles, plumbing, woodwork, and electrical fittings.

-

Foundation Strength – Ensure the building follows structural safety norms, especially in flood-prone areas like Velachery and ECR.

-

Third-Party Quality Certification – Request any available reports.

4. Overlooking Parking & Common Area Issues

Many builder floor projects have limited or no parking spaces and poorly planned common areas.

What to Check?

-

Dedicated Parking Space – Ensure there is an exclusive parking slot in the sale agreement.

-

Staircase & Lift Availability – If the building has multiple floors, check if a lift is provided and maintained.

-

Water & Drainage System – Confirm there is no dependency on water tankers and that sewage disposal is properly planned.

Also Read: Top Areas To Buy Builder Floor Apartment in Chennai

5. Ignoring Flood & Waterlogging Risks

Chennai is prone to heavy rainfall and flooding (e.g., areas like Velachery, Pallikaranai, and Medavakkam).

What to Check?

-

Verify if the area has a history of waterlogging during monsoons.

-

Check the apartment’s elevation and drainage system.

-

Ask about water sources (borewell, metro water) and backup solutions.

| "BEST BUILDER FLOOR APARTMENT IN CHENNAI" |

6. Not Clarifying Maintenance & Security Aspects

Unlike gated communities, builder floor apartments often lack proper maintenance and security services.

What to Check?

-

Who will handle building maintenance? (Owners’ association or third party)

-

Are CCTV cameras, security guards, and intercom facilities available?

-

Is there a garbage disposal system in place?

7. Ignoring the Builder’s Reputation

Some builders cut corners with construction quality and approvals.

What to Check?

-

Research the builder’s past projects and reviews.

-

Visit their previous constructions to assess build quality and timely delivery.

-

Verify if the builder has faced legal disputes or complaints on TNRERA.

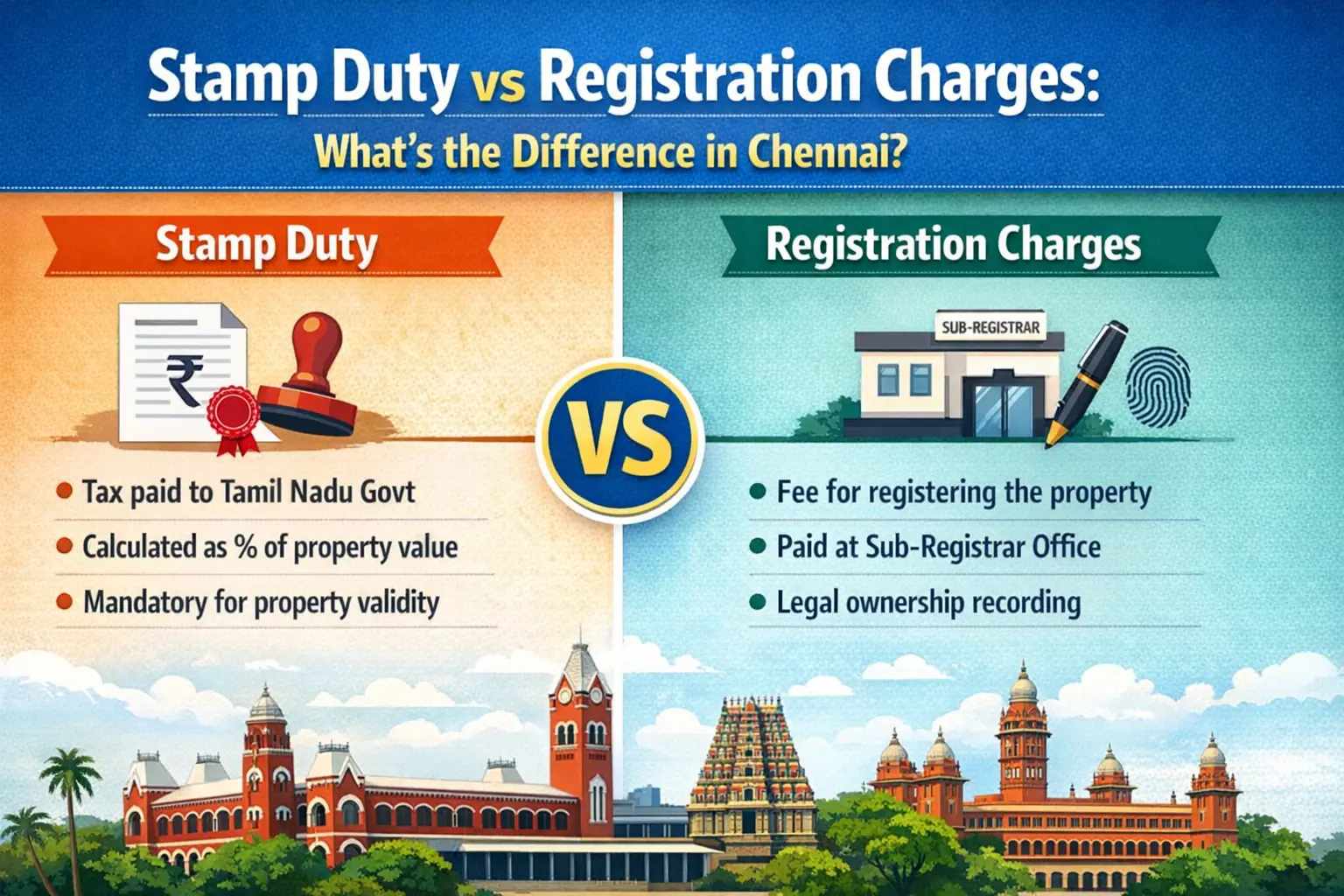

8. Not Understanding Hidden Costs

Apart from the property price, there are hidden expenses like GST, legal fees, and maintenance charges.

What to Check?

-

Stamp Duty & Registration – Around 7% stamp duty + 1% registration charge in Tamil Nadu.

-

GST on Under-Construction Property – 5% (non-affordable) or 1% (affordable) if the project is still under construction.

-

Legal & Documentation Fees – Ensure legal costs are included in the budget.

9. Failing to Get a Home Loan Pre-Approval

Not all builder floor apartments qualify for home loans, especially if approvals are incomplete.

What to Check?

-

Ensure the builder has tie-ups with reputed banks.

-

Get a pre-approved home loan to check loan eligibility.

-

Verify if the project has received bank approvals (SBI, HDFC, ICICI, etc.).

10. Not Checking Resale & Rental Value

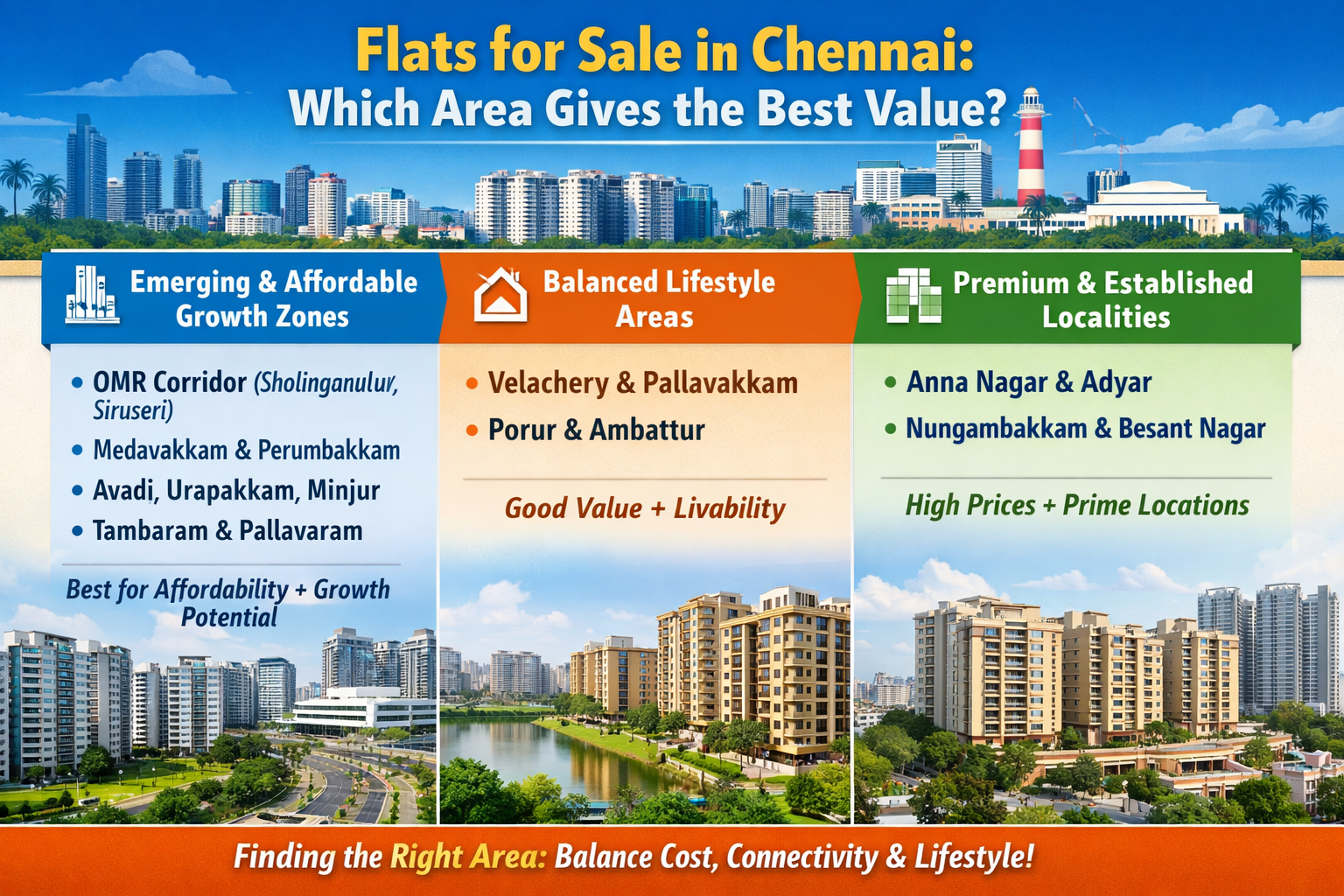

Some builder floor projects may have low resale value or rental demand due to poor location or lack of amenities.

What to Check?

-

Research the resale prices in the area.

-

Check the rental demand if buying for investment.

-

Ensure the property is close to schools, hospitals, metro stations, and IT hubs for better appreciation.

Also Read: NRI Guide to Investing in Builder Floor Apartment in Chennai

Buying a builder floor apartment in Chennai requires careful legal, financial, and structural verification. Avoiding these common mistakes can save you from legal disputes, poor-quality construction, and financial losses.

https://www.livehomes.in/blogs