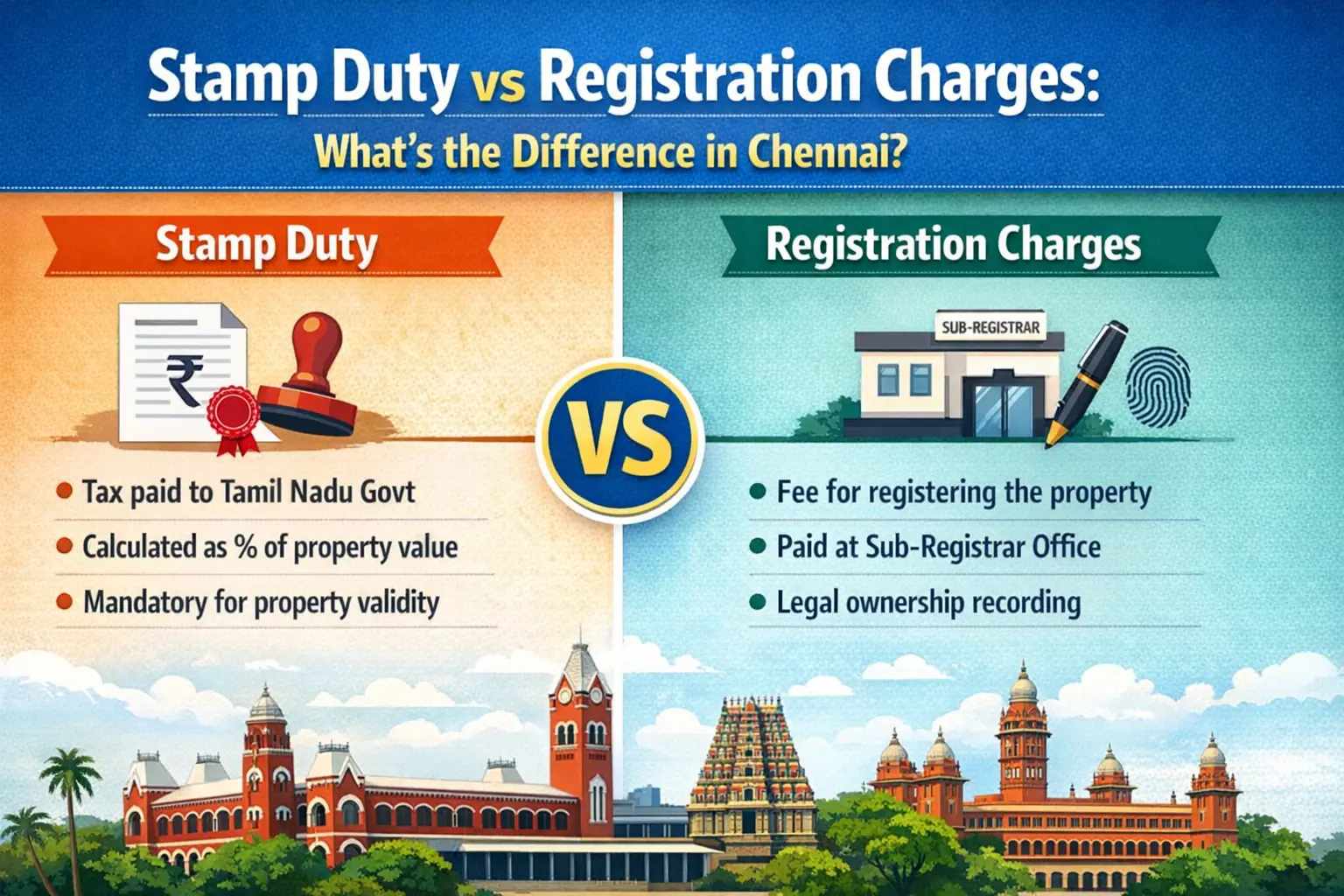

Stamp duty in Tamil Nadu is a tax levied on certain legal documents, particularly those related to the transfer of property, such as sale deeds, gift deeds, and lease agreements. Here’s a detailed overview:

Key Aspects of Stamp Duty in Tamil Nadu

-

Rate of Stamp Duty:

- The stamp duty for the sale of residential property is typically 7% of the market value of the property.

- For agricultural land, the rate is usually lower, around 4%.

- Other documents, such as gift deeds and lease agreements, have varying rates based on the duration and value.

-

Market Value Assessment:

- Stamp duty is calculated based on the market value of the property, which is determined by the government’s guideline value. This value is usually published and updated periodically by the state government.

-

Registration Fees:

- In addition to stamp duty, a registration fee is also applicable, usually around 1% of the value of the property.

-

Exemptions and Concessions:

- Certain transactions may qualify for exemptions or reduced rates, such as transactions involving specific categories of individuals (like family members) or types of properties (like those meant for affordable housing).

-

Payment of Stamp Duty:

- Stamp duty can be paid at designated banks or through the online portal of the Government of Tamil Nadu.

- It’s essential to pay the stamp duty before executing the document to avoid penalties.

-

Penalty for Non-Compliance:

- Failing to pay the stamp duty or registering the document can result in penalties, including fines and legal complications.

-

Timeframe for Payment:

- Stamp duty must generally be paid within a stipulated period from the date of execution of the document, usually 30 days.

Additional Considerations

- E-Stamping: Tamil Nadu offers an e-stamping facility for ease of payment, allowing users to pay stamp duty online.

- Document Types: Common documents subject to stamp duty include sale deeds, mortgage deeds, lease agreements, and power of attorney.

- Recent Changes: Stay updated with any amendments or changes to the stamp duty structure by checking official government notifications.

Conclusion

Understanding stamp duty is crucial for anyone involved in property transactions in Tamil Nadu. It’s advisable to consult with legal professionals or property experts for specific transactions to ensure compliance with all regulations.

Also read: Mortgages Insurance

https://www.livehomes.in/blogs