The term composite value refers to a combined value derived from multiple factors or variables that influence the value of a property or a real estate investment. It aggregates different elements, such as property characteristics, market conditions, and financial data, to provide a comprehensive assessment of a property's overall worth or the performance of a real estate investment.

The composite value in real estate can be used to assess both individual properties and larger real estate portfolios, offering insights into property pricing, trends, and potential investment returns.

Key Components of Composite Value in Real Estate

The composite value of a property or real estate investment typically involves multiple components that are weighted or combined based on their significance to the overall valuation. Here are some of the primary factors that contribute to the composite value:

-

Property Characteristics

- Size of the Property: The total square footage or land area, which is a fundamental factor in determining value.

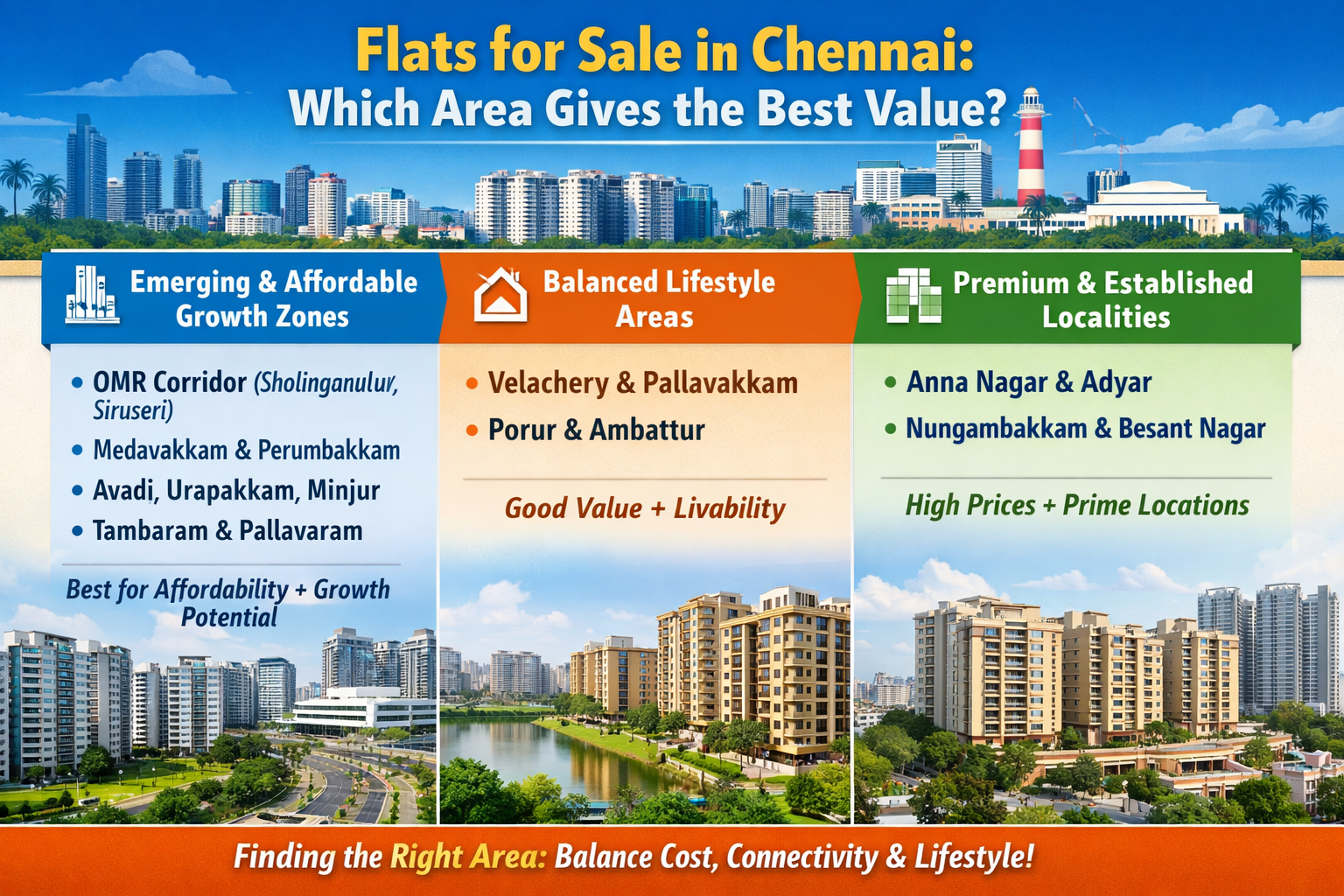

- Location: The property's location is one of the most critical factors affecting value. Proximity to amenities, public transport, schools, parks, and commercial hubs plays a big role. Location can be assessed with a composite value of factors like neighborhood desirability, accessibility, and potential for future growth.

- Age and Condition of the Property: Older properties might have historical or aesthetic value, but may also require more maintenance, affecting their composite value. Newer properties or recently renovated properties typically carry higher value due to modern amenities and fewer maintenance concerns.

- Design and Layout: The architectural style, the quality of materials used, and how the space is laid out can affect the composite value of a home or commercial property.

- Amenities: In residential real estate, this includes features like swimming pools, gyms, parking, smart home technology, and other high-demand amenities that can increase a property's perceived value.

-

Market Conditions

- Local Real Estate Market Trends: The overall state of the real estate market, such as whether it's a seller’s or buyer’s market, affects property values. Composite values reflect these market trends, accounting for factors like recent sales, price trends, and demand levels.

- Economic Factors: Broader economic indicators, such as interest rates, inflation, employment rates, and consumer confidence, influence real estate values. These factors could be incorporated into a composite value calculation for a market or a specific property type.

- Supply and Demand: A shortage of properties in a specific area (high demand, low supply) or an oversupply of properties can significantly impact real estate values and contribute to the composite value.

-

Comparable Sales (Comps)

- Comparable Properties: One of the most widely used methods in real estate to determine the value of a property is the analysis of comparable sales (also called "comps"). The composite value would consider recent sales of similar properties in the area to give a rough estimate of market value. The data might include adjustments for differences in size, location, amenities, and condition of properties.

-

Income Potential (for Investment Properties)

- Rental Income: For income-generating properties (like multi-family homes, apartment buildings, or commercial real estate), the composite value will factor in the potential rental income. This includes the monthly rent per unit or square foot and the property’s capacity to generate cash flow over time.

- Cap Rate: The capitalization rate (cap rate) is a key metric for assessing the potential return on investment in real estate. It compares the income generated by the property to its value. The cap rate is used to calculate a composite value that reflects the property's financial performance.

-

Investment and Development Potential

- Future Appreciation: Investors often look at the potential for a property to appreciate in value over time. This could be influenced by nearby developments, infrastructure projects, or urban renewal efforts that may boost the area’s desirability and property prices.

- Zoning and Land Use: The property’s zoning and the potential for development or re-zoning to a higher-value use can significantly impact its composite value, especially for investors or developers. If the property has the potential for future development (like adding extra units or converting the property into a higher-value commercial space), this adds to its long-term value.

-

Legal and Regulatory Factors

- Title and Ownership: Legal aspects such as the property's title, deed restrictions, and encumbrances can impact its value. A composite value would account for the potential costs or limitations related to legal disputes or zoning issues.

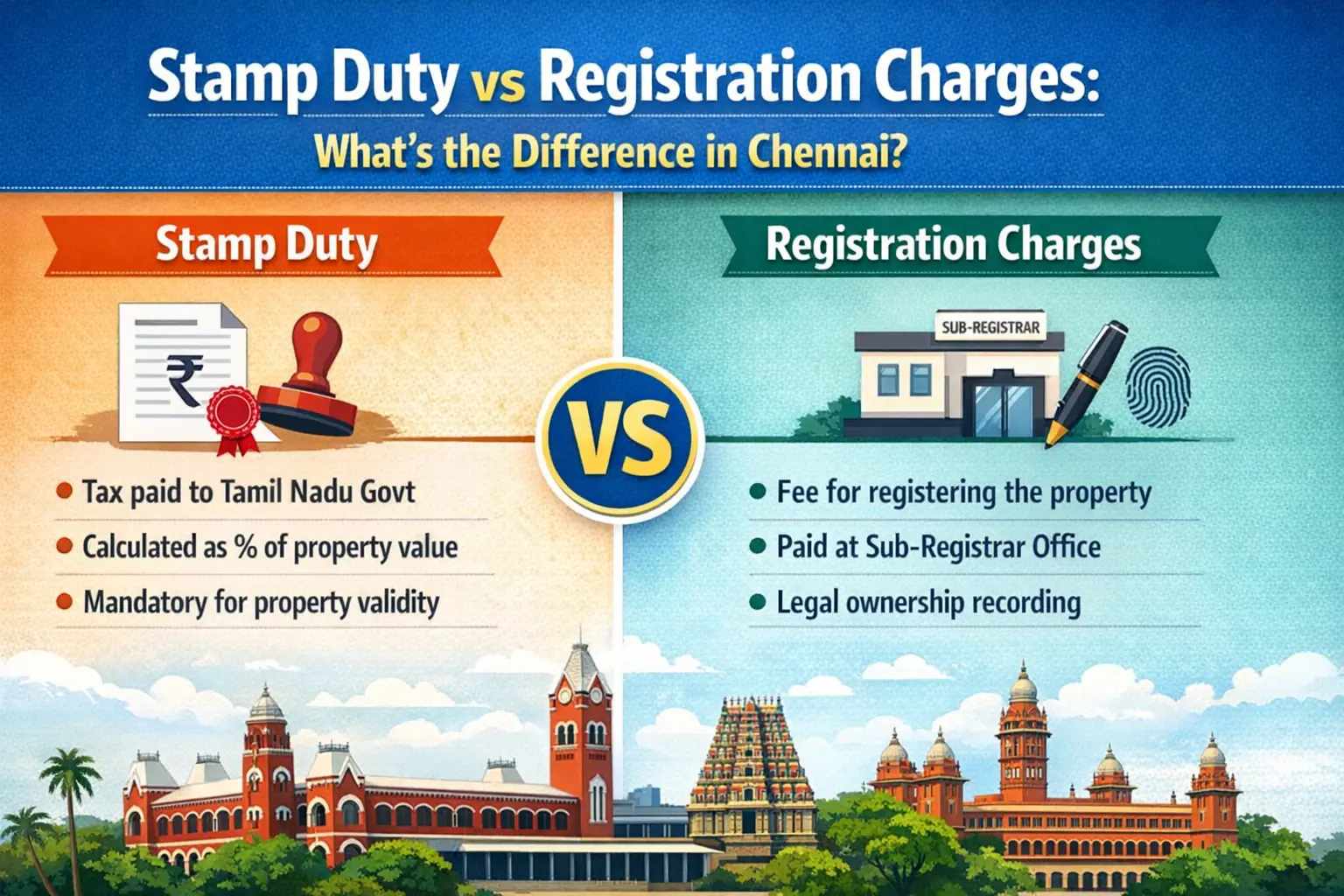

- Taxation and Fees: Property tax rates and any applicable special assessments or fees (such as HOA fees for residential properties) also factor into the composite value, affecting the cost of ownership.

-

Risk Factors

- Environmental Risks: The property’s location in relation to flood zones, earthquake zones, or areas with other environmental risks may reduce its composite value. Investors will often discount the value of properties that are at high risk for environmental issues.

- Market Volatility: The perceived volatility or stability of the local market can influence the composite value, particularly for investment properties. In areas with a history of rapid price swings, investors may apply a discount to the composite value to account for these risks.

| "BEST BUILDER FLOOR APARTMENT IN CHENNAI" |

Calculation and Use of Composite Value in Real Estate

The composite value of a property or real estate portfolio can be calculated using several different methods, depending on the purpose of the valuation (e.g., for sale, for investment, or for insurance purposes). Some methods for determining composite values include:

-

Comparative Market Analysis (CMA): A CMA is often used by real estate agents to determine a property’s market value based on recently sold properties with similar characteristics. The composite value here would combine factors like location, size, and amenities, and adjust for differences between properties.

-

Income Approach (for Investment Properties): For properties with income-generating potential, the income approach is used. This method calculates the composite value based on the potential income generated (via rent) and the expenses involved (such as maintenance, taxes, and management costs). The property’s income stream is then discounted by a cap rate to determine the property’s value.

-

Sales Comparison Approach: This method looks at recent sales data for similar properties in the same location to determine a fair market value. The composite value might involve adjustments based on differences in features, like square footage or age, from the comps.

-

Cost Approach: This approach involves adding the value of the land and the current cost of rebuilding or replacing the property (after depreciation). This method is useful for newer or unique properties where there aren't many comparable sales.

Also Read: Guideline Value in Tamil Nadu in 2025

Real-World Examples

-

Residential Real Estate: A real estate agent may calculate a composite value for a home based on the prices of similar homes sold in the neighborhood, adjustments for amenities like a swimming pool, and the overall condition of the property. If the home has a renovated kitchen, new roof, and modern HVAC system, these factors increase the composite value.

-

Commercial Real Estate: For commercial properties, such as office buildings or retail spaces, the composite value could combine factors such as the building’s income potential (rental income), the condition of the building, market rental rates, and comparable property prices. A building in a high-demand area with low vacancy rates would have a higher composite value.

-

Investment Property: An investor considering purchasing a multi-family property would calculate a composite value by looking at the property’s current rent roll, operating expenses, and market cap rate. The composite value would help determine whether the property offers a good return on investment compared to other similar investment opportunities.

In real estate, the composite value provides a more comprehensive view of a property's worth by aggregating multiple factors, including property characteristics, market conditions, income potential, and financial metrics. By factoring in a range of variables, the composite value helps investors, buyers, and real estate professionals make more informed decisions, whether it's for buying, selling, or evaluating real estate investments.

https://www.livehomes.in/blogs