The Goods and Services Tax (GST) applies differently to ready-to-occupy flats and under-construction flats in India. Understanding these differences is crucial for homebuyers and real estate investors.

1. GST on Ready-to-Occupy Flats (Completed Properties)

GST Rate: 0% (No GST Applicable)

- Definition: A ready-to-occupy flat is one that has received a Completion Certificate (CC) from the competent authority or where possession has been given without the requirement of a CC.

- Legal Basis: As per Schedule III of the CGST Act, 2017, the sale of land and buildings (where CC is issued) is neither treated as a supply of goods nor as a supply of services, hence outside the scope of GST.

Why?

- As per GST laws, GST is not applicable on the sale of completed flats or resale properties because they are considered "immovable property" under Schedule III of the GST Act.

- A property is deemed completed when it has received a Completion Certificate (CC) from the competent authority.

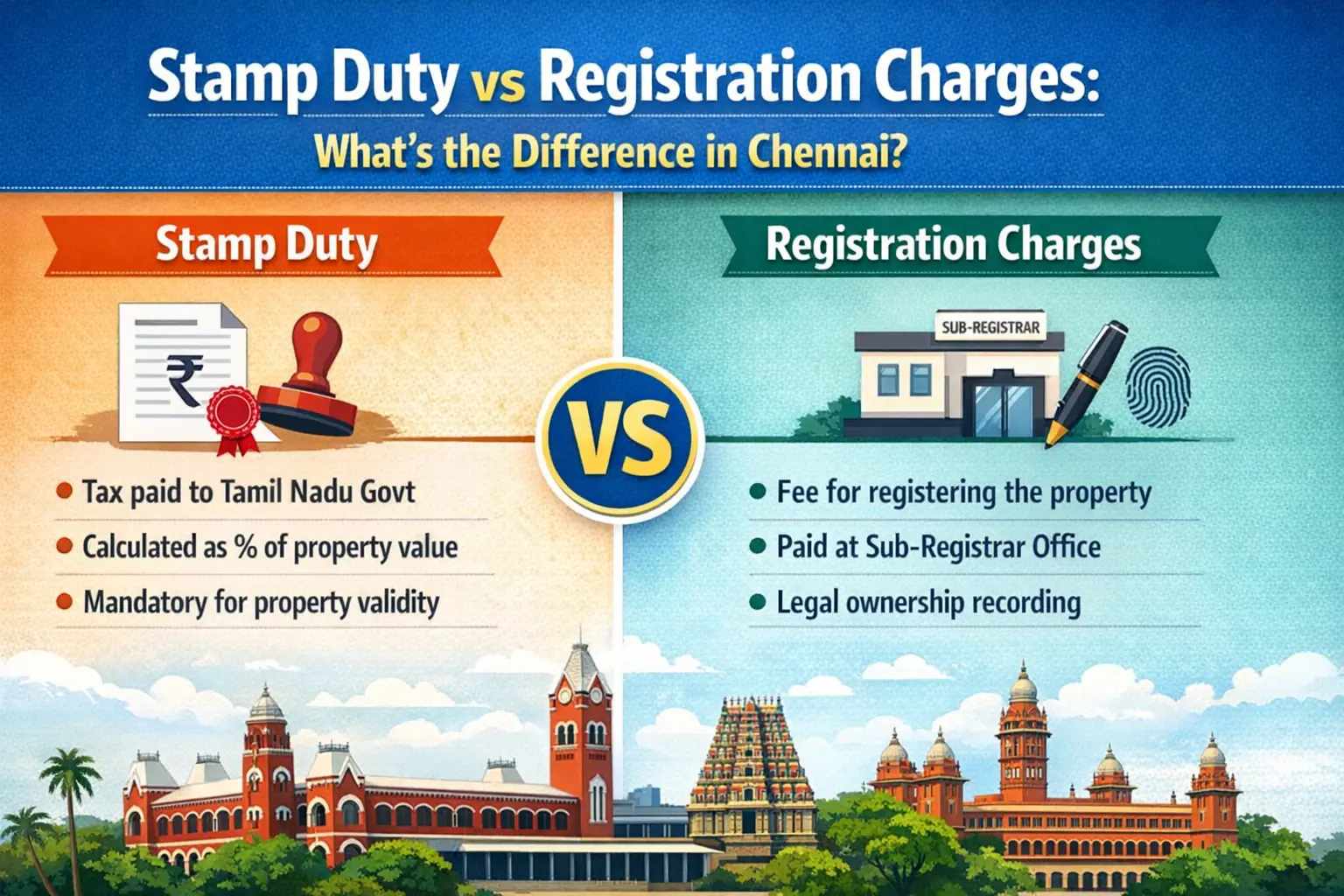

- If a property is sold after the issuance of the Completion Certificate, it does not fall under GST but is subject to stamp duty and registration charges.

Key Points:

- No GST on secondary sales (resale of flats).

- Only stamp duty and registration charges apply, which vary by state (usually between 5% to 8%).

- The buyer saves on GST but must ensure the property has an official CC to avoid disputes.

Other Charges Still Applicable:

- Stamp Duty: Varies between 5% to 8% depending on the state.

- Registration Charges: Usually 1% of the property value.

- Maintenance and Clubhouse Charges: If charged separately, GST may apply at 18%.

2. GST on Under-Construction Flats (New Properties)

GST is applicable on the sale of under-construction flats as it’s considered a supply of services under GST law.

(a) Affordable Housing Projects (AHP)

- GST Rate: 1% (without Input Tax Credit - ITC)

- Criteria for Affordable Housing:

- Metro Cities: Carpet area up to 60 sq. meters (645 sq. ft.) & value up to? 45 lakhs.

- Non-Metro Cities: Carpet area up to 90 sq. meters (968 sq. ft.) & value up to? 45 lakhs.

- No ITC: Developers cannot claim input tax credit on raw materials, which might increase construction costs slightly.

(b) Non-Affordable Housing Projects (Other Residential Properties)

- GST Rate: 5% (without Input Tax Credit - ITC)

- Applicable to residential flats that do not meet the affordable housing criteria.

3.Old GST Regime (Before April 1, 2019)

Some projects launched before April 1, 2019, chose to remain in the old GST structure.

- Affordable Housing: 8% (with ITC)

- Non-Affordable Housing: 12% (with ITC)

- Benefit: Developers could claim ITC, potentially lowering costs.

- Limitation: Developers needed to pass on ITC benefits to buyers, as per anti-profiteering provisions.

| "BEST BUILDER FLOOR APARTMENT IN CHENNAI" |

4. Special Cases

Under Construction in Commercial Complexes (with Residential Component)

- If residential units are part of a commercial project (like mixed-use developments), GST could be 12% with ITC.

Calculation of GST

For under-construction flats:

- GST applies only on the construction value, not on the land value.

- Standard Deduction for Land: 1/3rd of the total cost is considered the land value (as per government rules), and GST is calculated on the remaining 2/3rd.

Example:

- Total Cost = ?60 lakhs

- Land Value Deduction (1/3) = ?20 lakhs

- Taxable Value = ?40 lakhs

- GST (5%) = ?2 lakhs

5. Exceptions & Exemptions

- No GST if the flat is purchased after the issuance of a Completion Certificate.

- No GST on resale flats (secondary market).

- GST on Advance Payments: If you pay an advance for an under-construction flat, GST applies to the advance amount as well.

6. Impact of GST on Buyers & Developers

-

For Buyers:

- Under-Construction Properties: Subject to GST (5% or 1%).

- Ready-to-Occupy Properties: No GST, only stamp duty & registration fees.

- Affordable Housing Benefits: Lower GST at 1% encourages budget housing.

-

For Developers:

- Without ITC (New Regime): Increased construction costs, but simplified compliance.

- With ITC (Old Regime): Lower costs due to credit on raw materials, but strict compliance on passing benefits to buyers.

Conculsion:

- Buying a ready-to-occupy flat? No GST, but stamp duty and registration charges apply.

- Buying an under-construction flat? GST at 1% (affordable) or 5% (non-affordable) applies.

- Old projects (before April 1, 2019) may still have 8% or 12% GST with ITC.

- Always verify whether the GST charged is correct before making payments.

https://www.livehomes.in/blogs