If you're looking at long-term investment in real estate, both ready-to-occupy and under-construction properties have their advantages, but your choice depends on specific financial goals, risk appetite, and time horizon.

Ready-to-Occupy Properties for Long-Term Investment

Advantages for Long-Term:

-

Steady Rental Income:

- If your primary objective is to earn rental income consistently over the long term, ready-to-occupy properties are ideal as they can be leased out immediately.

-

Capital Appreciation in Prime Locations:

- Established localities with ready-to-move properties generally appreciate well over time, especially in metro cities and developed suburbs with strong infrastructure.

-

Low Risk, Stable Returns:

- With all approvals and legal clearances in place, the investment is relatively safe. Over time, the appreciation might be slower but steady.

-

Liquidity Advantage:

- Ready properties are easier to sell compared to under-construction projects, especially in well-developed areas, providing better liquidity in the long term.

Disadvantages for Long-Term:

- Higher Initial Investment:

- The initial cost is higher, reducing the immediate ROI compared to under-construction properties.

- Slower Appreciation Rate:

- Since much of the appreciation has already occurred by the time the property is ready, the rate of long-term appreciation might be lower compared to an under-construction project.

| "BEST BUILDER FLOOR APARTMENT IN CHENNAI" |

Under-construction properties for Long-Term Investment

Advantages for Long-Term:

-

Higher Capital Appreciation Potential:

- Investing in under-construction properties offers substantial appreciation by the time the project is completed and even more over the long term as the area develops.

-

Lower Entry Cost:

- You invest at a lower price compared to ready properties, which means higher returns when the property is sold after a long holding period.

-

Flexible Payment Plans:

- Developers offer staggered payment options, making it easier for investors to manage finances during the investment period.

-

Newer Infrastructure and Modern Amenities:

- Long-term investments in newly developed or upcoming areas can yield higher returns as the locality grows, infrastructure improves, and demand increases over time.

Disadvantages for Long-Term:

- Construction Delays and Regulatory Risks:

- Delays or legal complications could extend the timeline, impacting your investment plans and returns.

- No Immediate Returns:

- You miss out on rental income during the construction phase, which could last for years.

- Market and Developer Risks:

- Long-term commitments in under-construction projects are dependent on market conditions and the reliability of the developer.

Also read: GST for Ready to Occupy and Under Construction flats

Which is Better for Long-Term Investment?

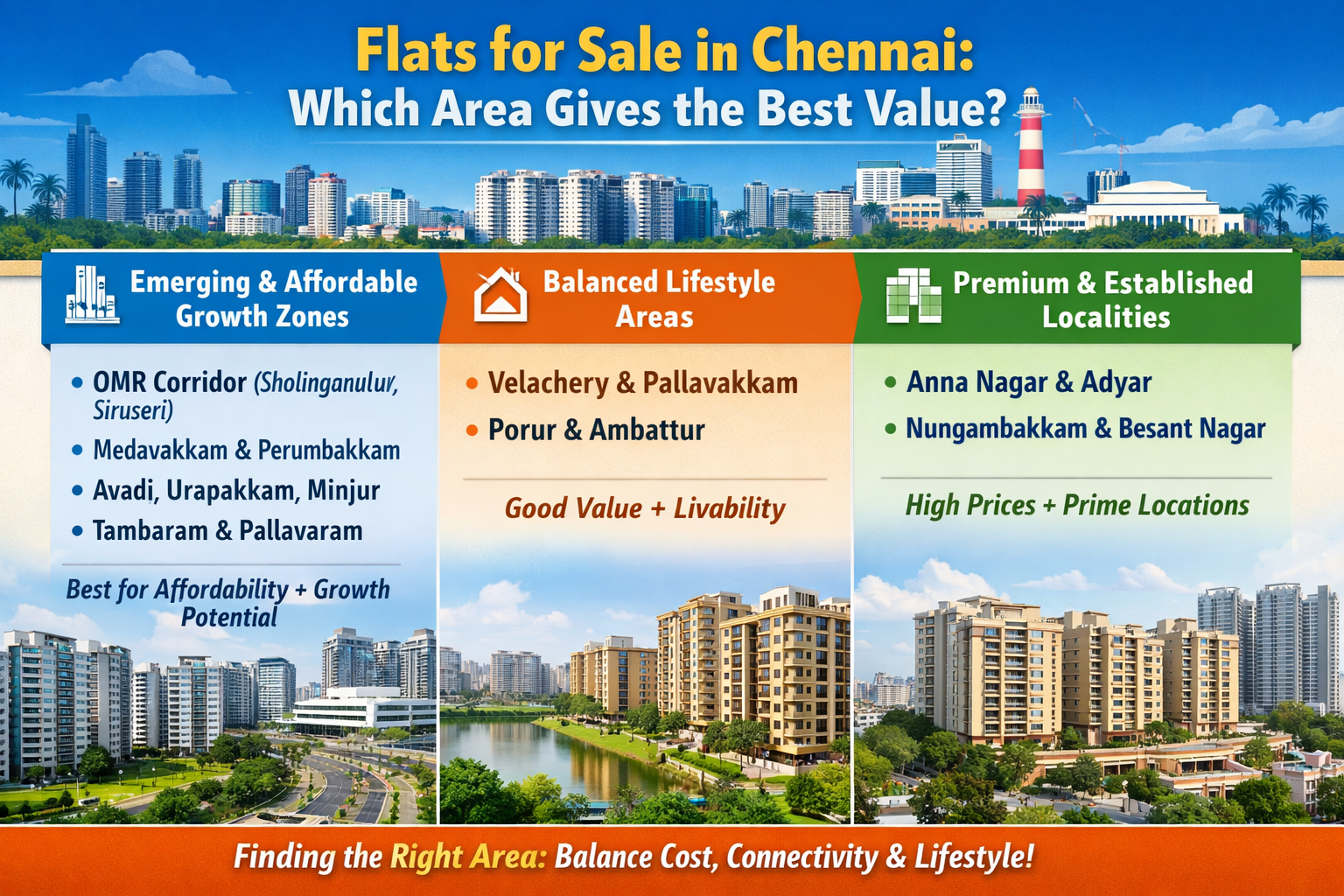

- Under-Construction Property Wins in Terms of Higher Long-Term Gains:

- If you have the time and patience, under-construction properties, especially in rapidly developing areas or expanding city suburbs, generally offer higher capital appreciation over the long term.

- Ready-to-Occupy Property Wins in Terms of Stability and Immediate Returns:

- If your priority is long-term rental income and a secure, stable investment with minimal risk, ready-to-move-in properties in prime locations are more suitable.

Ideal Scenario for Long-Term Investors:

- Invest in under-construction projects in emerging localities for higher appreciation over a 7-15 year horizon.

- If you want immediate income along with capital appreciation, opt for a ready-to-move property in established areas and hold it for at least 10-20 years.

https://www.livehomes.in/blogs