Buying a home is a significant investment, and for many people, it's a dream come true. However, buying a home can be a complex process, especially when it comes to under-construction properties. In Chennai, many homebuyers opt for under-construction properties, which can be a good option for those who want to own a brand-new home. However, it's essential to understand the home loan process for under-construction properties to make an informed decision.

Types of Home Loans for Under-Construction Properties

There are two types of home loans available for under-construction properties in Chennai:

1. Construction Loan: This type of loan is disbursed in installments as the construction progresses. The loan amount is released in stages, and the borrower is required to make interest payments on the disbursed amount.

2. Pre-Approval Loan: This type of loan is approved before the construction begins. The borrower is required to make interest payments on the entire loan amount, even if the construction is not yet complete.

Key Features of Home Loans for Under-Construction Properties

Here are some key features to consider when taking a home loan for an under-construction property in Chennai:

1. Loan Amount: The loan amount is typically up to 80-90% of the property's value.

2. Interest Rate: The interest rate for under-construction properties is usually higher than for ready-to-move-in properties.

3. Repayment Tenure: The repayment tenure can range from 5-30 years, depending on the lender and the borrower's profile.

4. Pre-EMI Interest: The borrower is required to pay pre-EMI interest on the disbursed amount until the construction is complete.

5. Disbursement: The loan amount is disbursed in installments as the construction progresses.

6. Collateral: The property itself serves as collateral for the loan.

Documents Required for Home Loan for Under-Construction Property

Here are the documents typically required for a home loan for an under-construction property in Chennai:

1. Identity Proof: Passport, PAN card, Aadhaar card, etc.

2. Income Proof: Salary slips, Form 16, income tax returns, etc.

3. Address Proof: Utility bills, bank statements, etc.

4. Property Documents: Sale agreement, allotment letter, building plan, etc.

5. Construction Plan: A detailed construction plan, including the timeline and budget.

| "BEST BUILDER FLOOR APARTMENT IN CHENNAI" |

Benefits of Home Loan for Under-Construction Property

Here are some benefits of taking a home loan for an under-construction property in Chennai:

1. Lower EMI: The EMI amount is lower since the loan amount is disbursed in installments.

2. Flexibility: The borrower can choose to pay only the interest component during the construction period.

3. Tax Benefits: The borrower can claim tax benefits on the interest paid during the construction period.

Risks Associated with Home Loan for Under-Construction Property

Here are some risks associated with taking a home loan for an under-construction property in Chennai:

1. Project Delays: Delays in construction can lead to delays in loan disbursement and increased interest payments.

2. Project Cancellation: If the project is cancelled, the borrower may be required to repay the loan amount immediately.

3. Quality Issues: Poor construction quality can lead to reduced property value and increased maintenance costs.

Top Banks and Financial Institutions for Home Loan in Chennai

Here are some top banks and financial institutions that offer home loans for under-construction properties in Chennai:

1. SBI: State Bank of India

2. HDFC: Housing Development Finance Corporation

3. ICICI: ICICI Bank

4. Axis: Axis Bank

5. LIC: Life Insurance Corporation of India

Also read: What is Private Mortgage Insurance PMI

Tips for Borrowers

Here are some tips for borrowers taking a home loan for an under-construction property in Chennai:

1. Research: Research the developer, project, and lender before taking a loan.

2. Read the Fine Print: Carefully read the loan agreement and understand the terms and conditions.

3. Plan Your Finances: Plan your finances carefully to ensure timely EMI payments.

4. Monitor Construction Progress: Regularly monitor the construction progress to ensure timely completion.

Chennai-Specific Considerations

Here are some Chennai-specific considerations to keep in mind when taking a home loan for an under-construction property:

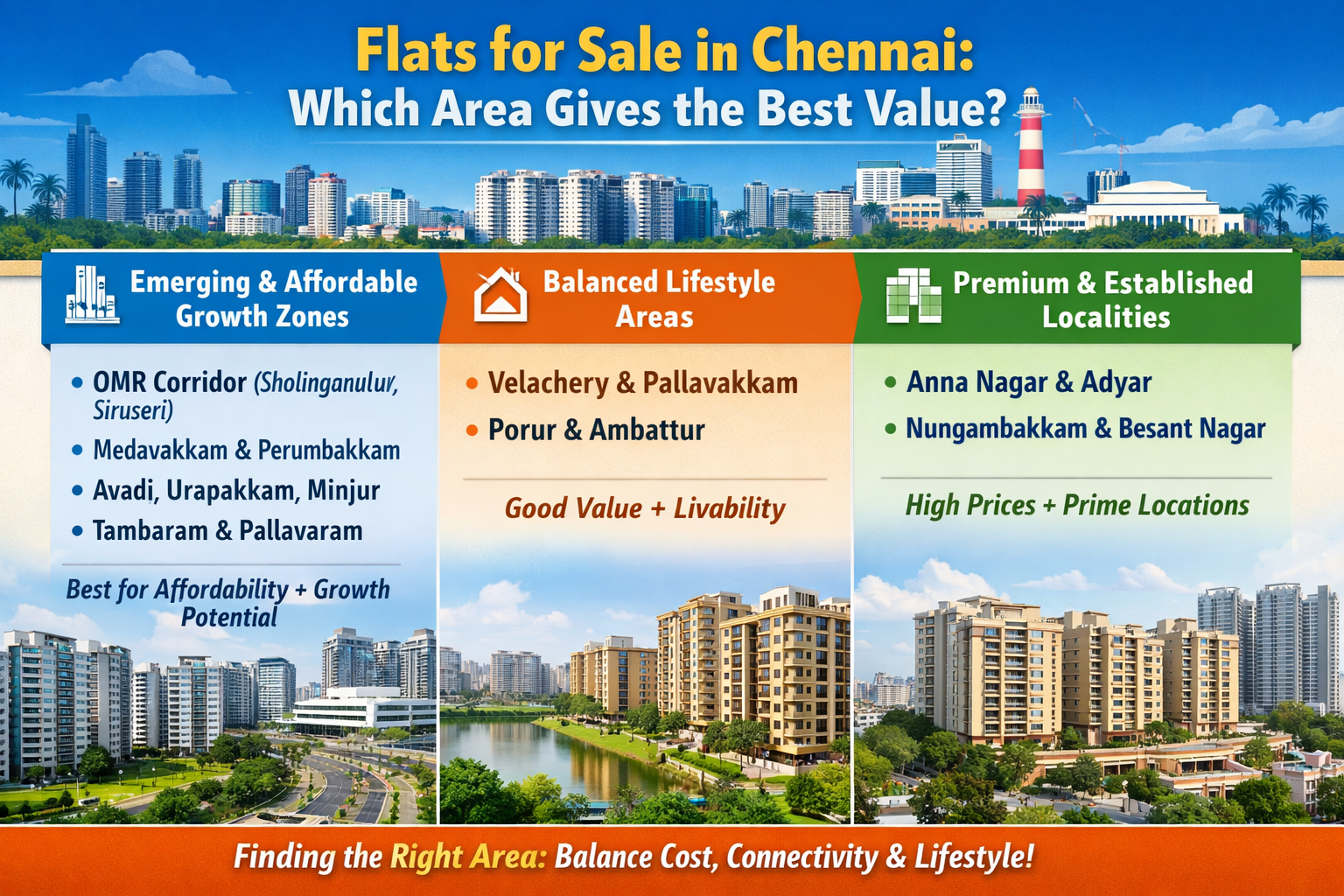

1. Chennai's Real Estate Market: Chennai's real estate market is known for its stability and growth, making it an attractive option for homebuyers.

2. Infrastructure Development: Chennai is undergoing significant infrastructure development, including the construction of new roads, metro lines, and other public transportation systems.

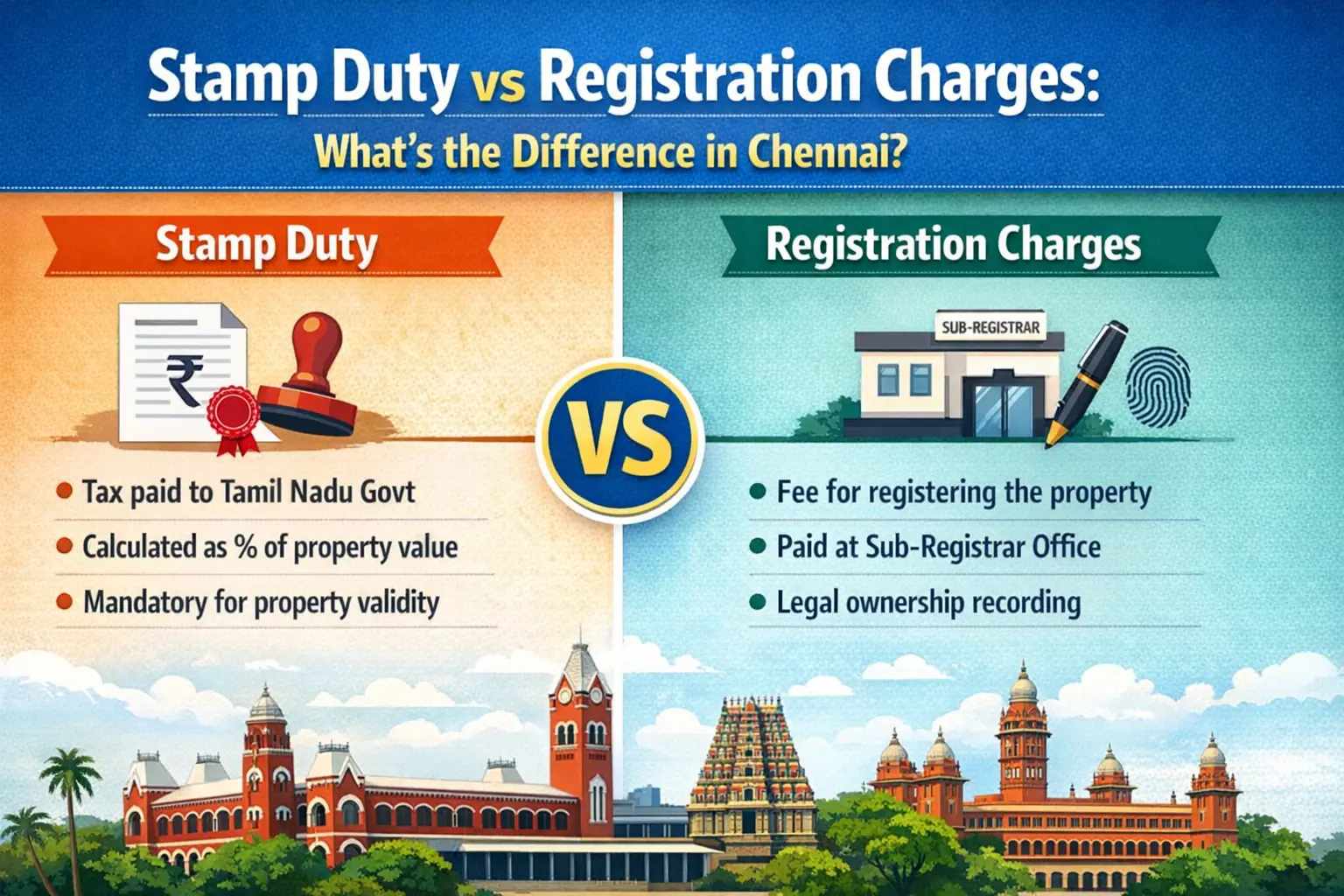

3. Regulatory Framework: The Tamil Nadu government has implemented various regulations to ensure transparency and fairness in the real estate sector.

https://www.livehomes.in/blogs