Understanding Adjustable-Rate Mortgages (ARMs) in 2025

Adjustable-Rate Mortgages (ARMs) are a popular mortgage option for homebuyers and homeowners looking to manage their monthly payments, especially in a fluctuating interest rate environment. While ARMs have been a part of the mortgage landscape for decades, their terms and characteristics are evolving, especially as we move into 2025. This guide will help you understand how ARMs work, what changes you can expect in 2025, and whether they might be the right choice for you.

1. What is an Adjustable-Rate Mortgage (ARM)?

An Adjustable-Rate Mortgage (ARM) is a type of home loan where the interest rate is not fixed but instead adjusts periodically based on a specific benchmark or index. These adjustments are typically made after an initial period with a fixed interest rate (the "initial rate period"), which can last anywhere from 3 to 10 years.

Key Characteristics of ARMs:

-

Initial Fixed Rate Period: ARMs typically have a fixed interest rate for a set period (e.g., 5, 7, or 10 years). After this period, the rate adjusts periodically.

-

Adjustment Period: After the initial fixed period, the interest rate adjusts annually, biannually, or on some other set schedule.

-

Index and Margin: The rate is tied to a financial index (like LIBOR or the U.S. Treasury index) plus a margin set by the lender.

-

Rate Caps: ARMs often have rate caps that limit how much the interest rate can increase during a given adjustment period and over the life of the loan.

2. How ARMs Work:

To better understand ARMs, let's break down the structure and mechanics:

a. Initial Fixed Period

The most attractive feature of an ARM is its low initial interest rate. For example, a 5/1 ARM has a fixed rate for the first 5 years, after which the interest rate adjusts once a year.

-

Example:

-

A 5/1 ARM might offer a rate of 3% for the first 5 years, after which the rate will adjust based on the index.

-

The initial rate is typically lower than that of a fixed-rate mortgage, which is why some borrowers opt for ARMs.

-

b. Adjustment Period

After the fixed-rate period, the rate adjusts based on changes in a benchmark index. The frequency of these changes can vary:

-

1-year ARMs: The rate adjusts every year after the initial period.

-

3-year ARMs: The rate adjusts every three years after the initial period.

These adjustments are usually based on an index rate (such as the SOFR (Secured Overnight Financing Rate) or LIBOR) plus a margin set by the lender. This margin is a fixed amount and does not change.

c. Rate Caps

ARMs come with caps to protect borrowers from significant rate increases:

-

Periodic Caps limit how much the interest rate can increase in one adjustment period (e.g., 2% per year).

-

Lifetime Caps limit how much the rate can increase over the life of the loan (e.g., 5% total).

d. Example of ARM Calculation:

-

Loan Type: 5/1 ARM with a starting rate of 3%

-

Index: SOFR (example) + 2% margin

-

Cap: 2% per adjustment period, 5% lifetime cap

If the SOFR index rises and leads to an adjustment that brings the rate up by 3%, the maximum increase in the first adjustment period would be 2% (due to the periodic cap). If the rate adjusts upwards every year after the fixed period, the rate can only increase by 2% per year, and the lifetime maximum rate would be 8%.

3. What to Expect from ARMs in 2025:

As we approach 2025, ARMs are likely to evolve in several key ways due to shifts in the market, regulatory changes, and technological advancements. Here are some trends and changes to look out for:

a. Rising Interest Rates

After a period of historically low interest rates, many forecasts predict that interest rates will remain higher in 2025. This means that ARMs could become more attractive again, as they allow homeowners to lock in a low rate for the initial fixed period before the rates adjust.

-

Impact: Homebuyers who opt for ARMs might benefit from a lower initial rate compared to fixed-rate mortgages, but after the initial period, the rate will likely increase due to rising interest rates.

b. SOFR as the New Benchmark

The shift from LIBOR (London Interbank Offered Rate) to SOFR as the global benchmark index is set to continue into 2025. SOFR is a more transparent and reliable index, which will affect ARM rates.

-

Impact: ARMs based on SOFR might become more common, and buyers may need to get familiar with how this index behaves, as it could lead to slightly more volatile interest rate changes.

c. Technology and Digital Tools for Rate Management

The use of digital tools and AI-powered platforms to calculate mortgage rates and manage adjustments will likely become more widespread. These tools may help borrowers better understand how their interest rates will adjust over time.

-

Impact: Borrowers will have better transparency in understanding how interest rates will change over the life of their loan and can make more informed decisions about their mortgage options.

d. Increased Flexibility with ARMs

In 2025, some lenders may begin offering more flexible ARMs, including options for longer fixed-rate periods or more frequent adjustments to better suit borrowers’ needs and expectations.

-

Impact: Some homebuyers may be able to lock in a longer fixed rate or choose more frequent adjustments to match their personal financial situation.

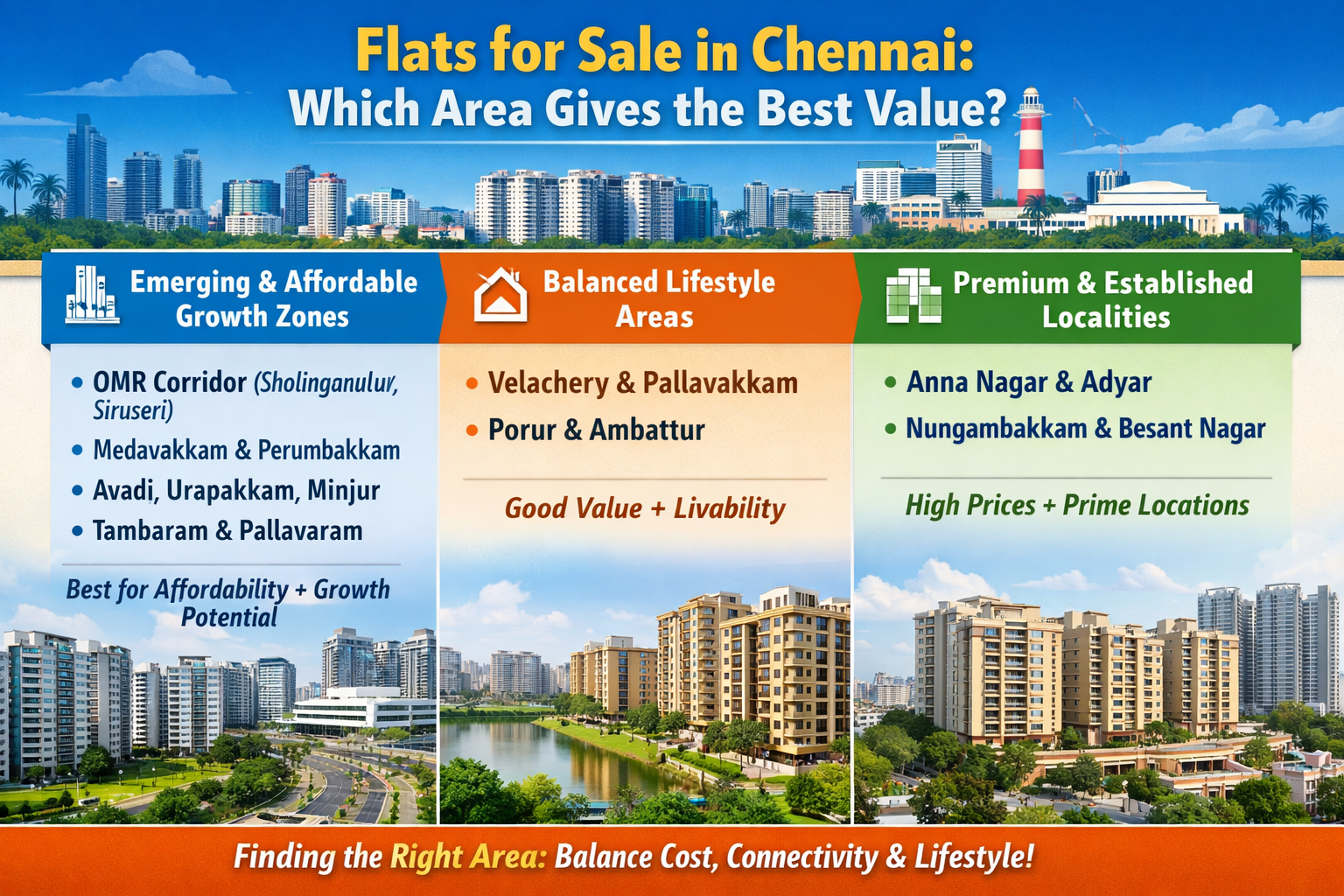

| "Best Builder Flor Apartment in Chennai" |

4. Advantages of ARMs in 2025:

While ARMs may seem risky due to the possibility of rate increases, they offer several advantages:

-

Lower Initial Rates: In a higher interest rate environment, ARMs offer an attractive initial rate, which can lead to lower monthly payments, especially in the early years of the mortgage.

-

Flexibility for Short-Term Homebuyers: ARMs can be beneficial for homebuyers who plan to sell or refinance their homes within the initial fixed-rate period, avoiding the risk of future rate increases.

-

Potential for Lower Rates in Early Years: If the housing market or interest rates stabilize or decline after the fixed-rate period, homeowners could benefit from lower payments over the long term.

5. Risks and Considerations:

Despite the benefits, ARMs also come with potential risks:

-

Rising Interest Rates: After the initial fixed period, your interest rate could increase significantly if rates rise, leading to higher monthly payments.

-

Uncertainty: ARMs carry an element of unpredictability. Borrowers who rely on fixed monthly payments may find it difficult to manage when their rate adjusts.

-

Caps and Limits: While rate caps offer some protection, they might not prevent payments from rising enough to strain your budget.

6. Is an ARM Right for You in 2025?

Choosing between an ARM and a fixed-rate mortgage depends on your financial goals and plans. ARMs are ideal for:

-

Homebuyers planning to sell or refinance before the adjustable period begins.

-

Those seeking lower initial payments and the ability to handle potential rate increases.

-

Homebuyers comfortable with some level of risk, and who can weather the volatility of adjusting rates.

Final Thoughts:

Adjustable-Rate Mortgages in 2025 are likely to evolve with market conditions, interest rates, and new technological advancements. With the right knowledge and careful planning, ARMs can be a beneficial mortgage option for homebuyers who want lower initial payments and can manage the risks associated with rate adjustments. Before committing to an ARM, it’s essential to understand how the rate changes, caps, and market conditions might affect your long-term financial stability.

https://www.livehomes.in/blogs