Buying a builder floor property can be a great investment, offering privacy, space, and a sense of independence. However, before making a purchase, it's essential to conduct thorough due diligence to avoid potential legal, financial, and structural issues. Here are the key things to check before buying a builder floor apartment:

1. Legal Verification of Property Documents

Ensuring that the property has clear legal documentation is crucial to avoid future disputes. Check for the following:

- Title Deed: Verify that the seller has a clear and legal title to the land and property.

- Sale Agreement: Ensure that the sale agreement includes all terms and conditions, including price, possession date, and penalties for delays.

- Encumbrance Certificate: This document confirms that the property is free from any legal dues or loans.

- Approved Building Plan: The builder must have approval from local authorities (municipal corporation, development authority, etc.).

- Completion Certificate (CC) & Occupancy Certificate (OC): The CC ensures the construction followed approved plans, and the OC confirms the building is safe for occupancy.

2. Land Ownership and Zoning Approvals

Since builder floors are typically constructed on independent plots, it is essential to verify:

- Ownership Rights: Check if the builder owns the land or if it is a joint development.

- Zoning and Land Use Approvals: Ensure that the land is designated for residential use as per the city’s master plan.

- Property Tax Receipts: Verify that the previous owner or builder has paid all due property taxes.

3. Builder’s Reputation and Track Record

Not all builders deliver what they promise. Research the builder’s history by:

- Checking previous projects and their quality.

- Reading online reviews and speaking to previous buyers.

- Ensuring the builder has followed regulatory approvals and is not involved in legal disputes.

4. Quality of Construction

Since builder floors are usually standalone constructions, poor-quality work is a common issue. Inspect the following:

- Structural Quality: Check for cracks in walls, dampness, or uneven flooring.

- Materials Used: Verify the quality of cement, bricks, and fittings.

- Plumbing and Electrical Work: Ensure proper wiring, drainage, and water pressure.

- Ventilation and Natural Light: Look for adequate windows and airflow in rooms.

5. Floor Area and Carpet Area Calculation

Real estate deals often involve confusion regarding built-up, super-built-up, and carpet areas.

- Carpet Area: The actual usable area inside the apartment.

- Built-up Area: Carpet area + thickness of walls + balconies.

- Super Built-up Area: Built-up area + common spaces (staircases, lobby, etc.).

- Always clarify how the property’s square footage is being calculated.

| "BEST BUILDER FLOOR APARTMENT IN CHENNAI" |

6. Parking and Common Amenities

Check whether the property comes with:

- Dedicated Parking Space: Some builder floors offer covered parking, while others may not.

- Water and Electricity Supply: Verify if there are water shortages or frequent power cuts in the area.

- Drainage and Sewage System: Ensure there are no past issues related to flooding or poor sewage connections.

7. RERA Registration (If Applicable)

If the property is under construction, check whether it is registered under the Real Estate Regulatory Authority (RERA) for transparency and legal protection. Visit the official RERA website to verify:

- Project registration details

- Completion timelines

- Complaints filed against the builder

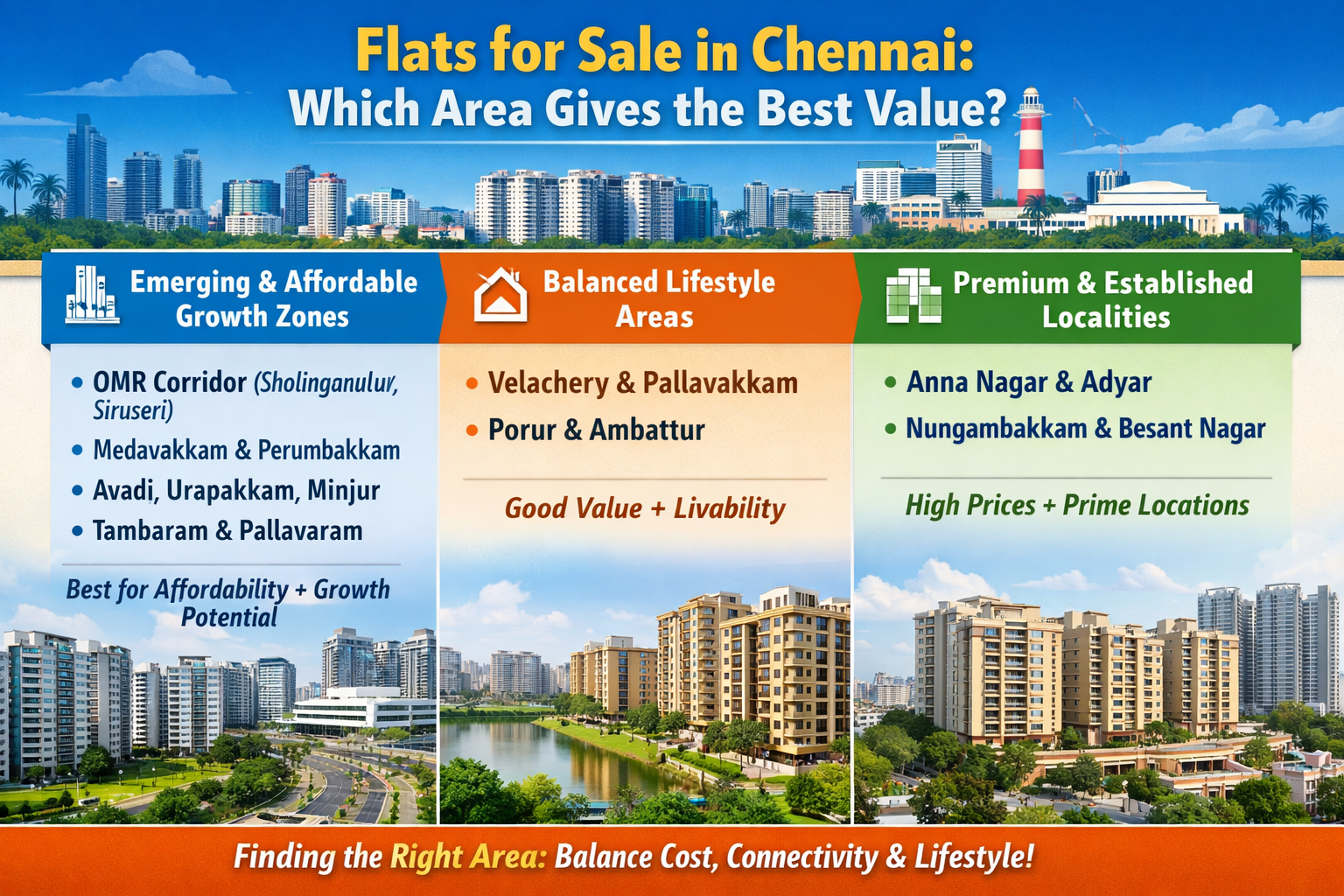

8. Connectivity and Neighborhood

Before finalizing a builder floor, consider:

- Proximity to Schools, Hospitals, and Markets: Ensures convenience in daily life.

- Public Transport and Road Access: Check if the area has good connectivity to major roads and public transport facilities.

- Safety and Security: Visit the locality during different times of the day to check for crime levels and security measures.

9. Resale Value and Future Growth Potential

If you plan to sell the property in the future, check for:

- Upcoming Infrastructure Developments: Metro stations, highways, malls, or business hubs nearby can increase property value.

- Demand in the Area: Research past property appreciation trends in the locality.

- Builder Floor vs. High-Rise Apartment Trends: Ensure that builder floors remain in demand in your selected area.

10. Home Loan and Financing Options

If you are taking a home loan, check:

- Bank Approval: Some banks avoid financing unauthorized builder floors.

- Loan Eligibility: Compare interest rates from different banks.

- Legal Verification by the Bank: If a reputed bank is financing the property, it’s an added assurance of legal clearance.

11. Maintenance and Society Rules

- Maintenance Costs: Find out if there are additional monthly maintenance charges.

- Common Area Ownership: Check how common areas like staircases, terraces, and parking are managed.

- Rental Potential: If buying for investment, check the demand for rental properties in the area.

https://www.livehomes.in/blogs