Whether 2025 is the best year to take a home loan depends on several factors, including current market conditions, interest rates, your personal financial situation, and broader economic trends. Here’s a breakdown of important elements to consider:

1. Interest Rates

Interest rates are one of the most important factors when deciding to take a home loan. Lower interest rates generally mean lower monthly payments and a cheaper loan in the long run.

-

Current trends: Interest rates fluctuate due to central bank policies, inflation rates, and economic conditions. For instance, in the last few years, central banks have raised interest rates to combat inflation, which has led to higher mortgage rates.

-

Forecast for 2025: If interest rates are expected to stabilize or drop, 2025 might be a good year to lock in a favorable rate. However, if rates are expected to remain high or increase further, waiting might be costly.

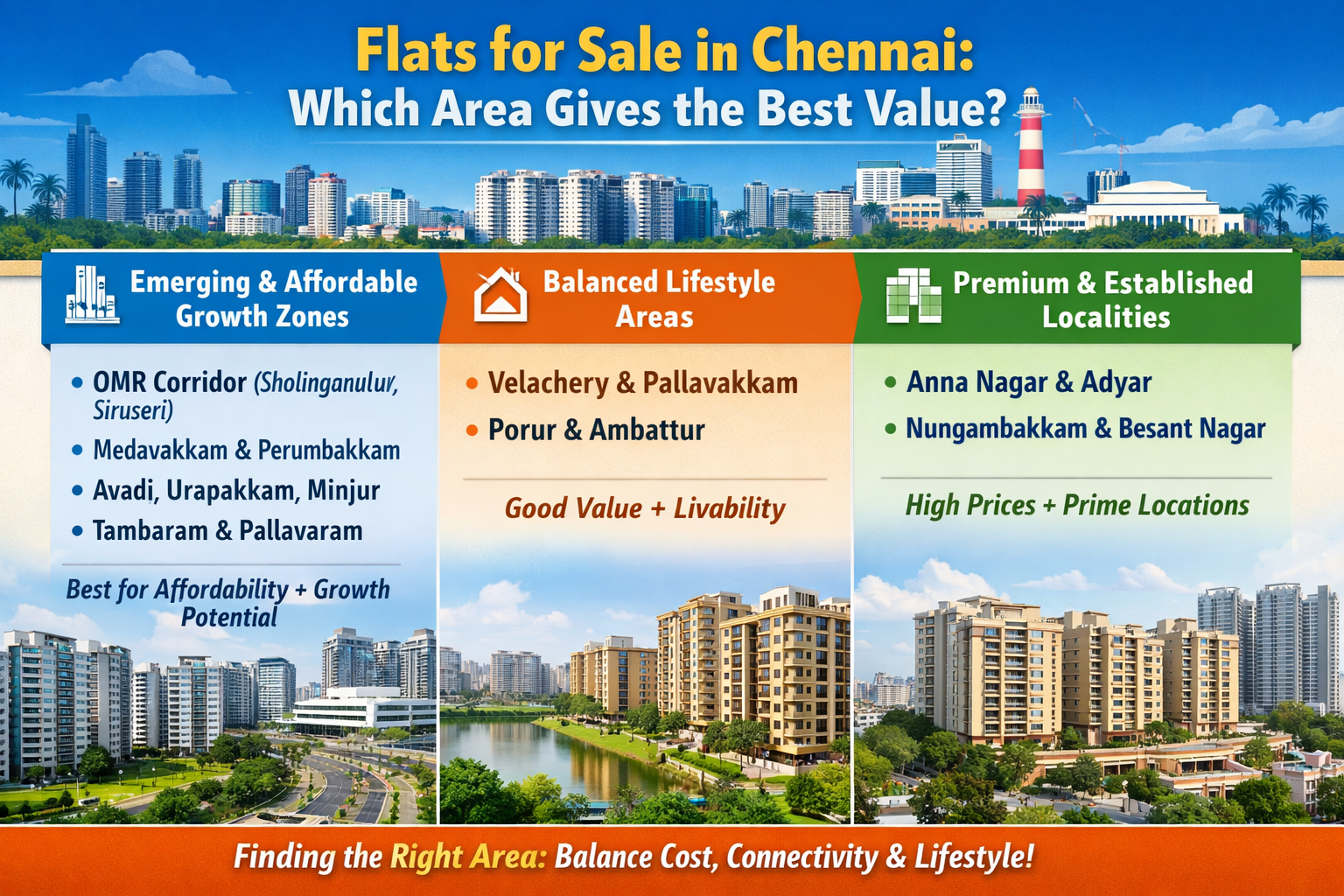

2. Real Estate Market Conditions

The state of the housing market will also play a big role.

-

Buyer’s vs. Seller’s Market: If housing prices are on the rise, it could be a seller’s market, making it more expensive to buy. If the market is cooling, it may be a better time to buy as prices stabilize.

-

Home Prices: Home prices can be influenced by interest rates, demand, supply, and economic conditions. A correction in housing prices may present an opportunity to buy.

3. Economic Outlook

The broader economic outlook for 2025 is crucial. Economic factors like inflation, GDP growth, and employment levels can influence your decision.

-

Inflation: Higher inflation can make homes more expensive, and central banks may respond by raising interest rates further.

-

Economic Growth: A strong economy may support rising home prices and a competitive housing market, while a slowdown could create opportunities for buyers.

4. Personal Financial Situation

-

Your Credit Score: Your credit score directly impacts the interest rate you're offered. If your credit score is strong, you'll likely receive better loan terms.

-

Down Payment: A larger down payment will reduce your loan amount and monthly payments. It’s essential to save up for a significant down payment if you want to minimize your mortgage costs.

-

Job Stability: Your job security and income level matter. Lenders look for borrowers with stable income sources.

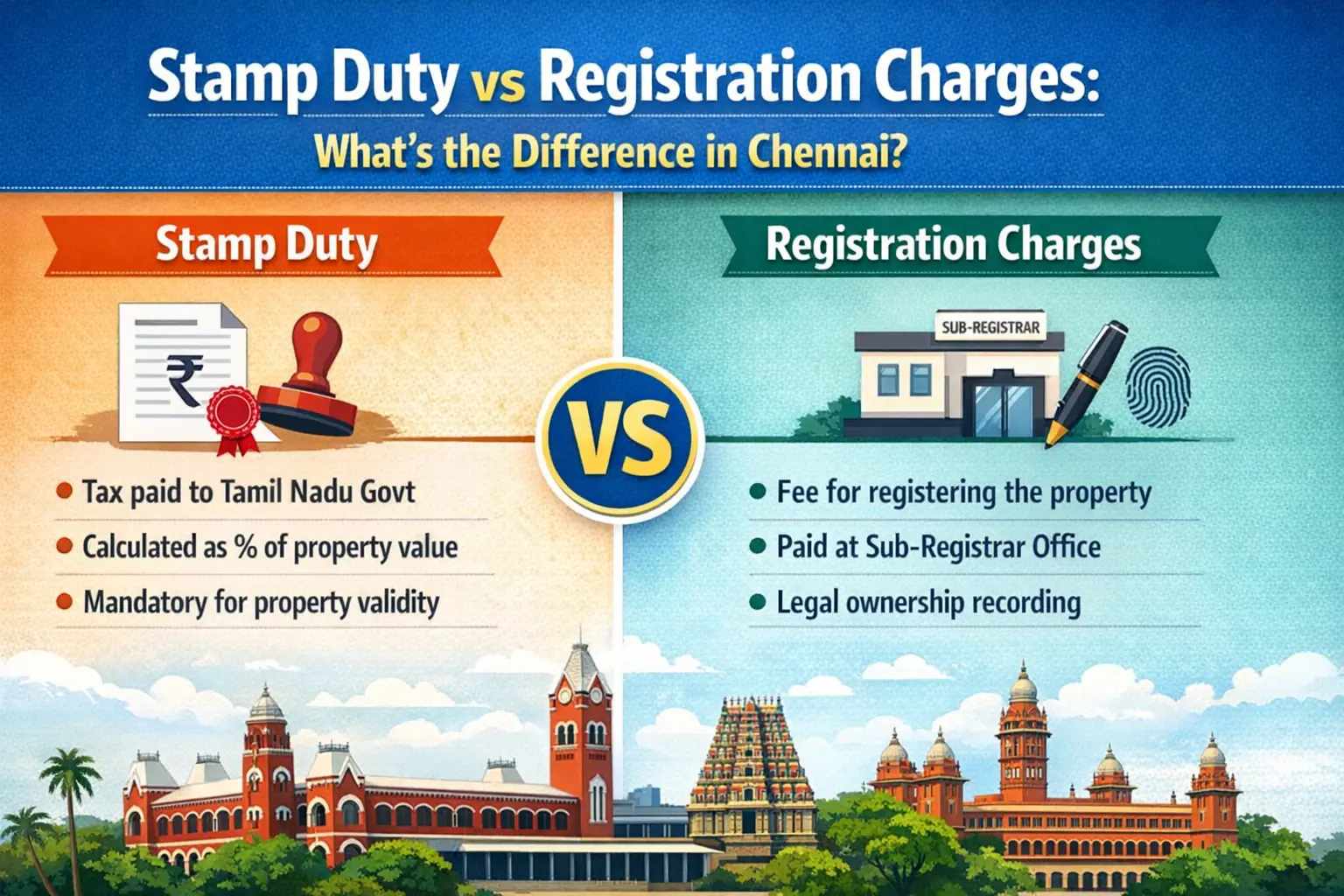

5. Government Policies and Incentives

Sometimes, governments offer incentives for first-time homebuyers or tax breaks. Research any new or upcoming government initiatives for 2025 that might benefit homebuyers.

6. Global Events

Events like global recessions, pandemics, or geopolitical instability can have a significant impact on interest rates and housing markets. 2025 could see the aftermath of current geopolitical issues or economic changes, which could make it harder or easier to secure favorable loan terms.

Read Also: Is Chennai Commerical Real Estate Market Growing Rapidly

Steps to Take Before Deciding:

-

Check Current Interest Rates: Compare rates from different lenders and consider locking in a rate if they are at a historical low.

-

Consult Financial Advisors: Speak with a financial planner or mortgage expert to assess your readiness for homeownership.

-

Monitor Economic Indicators: Keep an eye on inflation trends, housing market predictions, and central bank decisions.

-

Prepare Your Finances: Ensure that your credit score, down payment, and debt-to-income ratio are in good shape.

In 2025, if interest rates are favorable and the economy is stable, it could be a great year to take a home loan. However, personal factors like your financial situation, market conditions, and the real estate environment will play a significant role in your decision. Keep an eye on economic indicators and consult experts to get the best advice for your specific situation.

https://www.livehomes.in/blogs