The investment potential of a builder floor apartment can be evaluated from several angles, including location, rental income, appreciation, and risk factors. Builder floors are a type of residential property, typically found in cities or areas with high demand for housing. They are often multi-story structures that offer individual floors for sale as separate units, as opposed to buying a flat within a large apartment complex.

Here’s a detailed breakdown of the investment potential:

1. Location

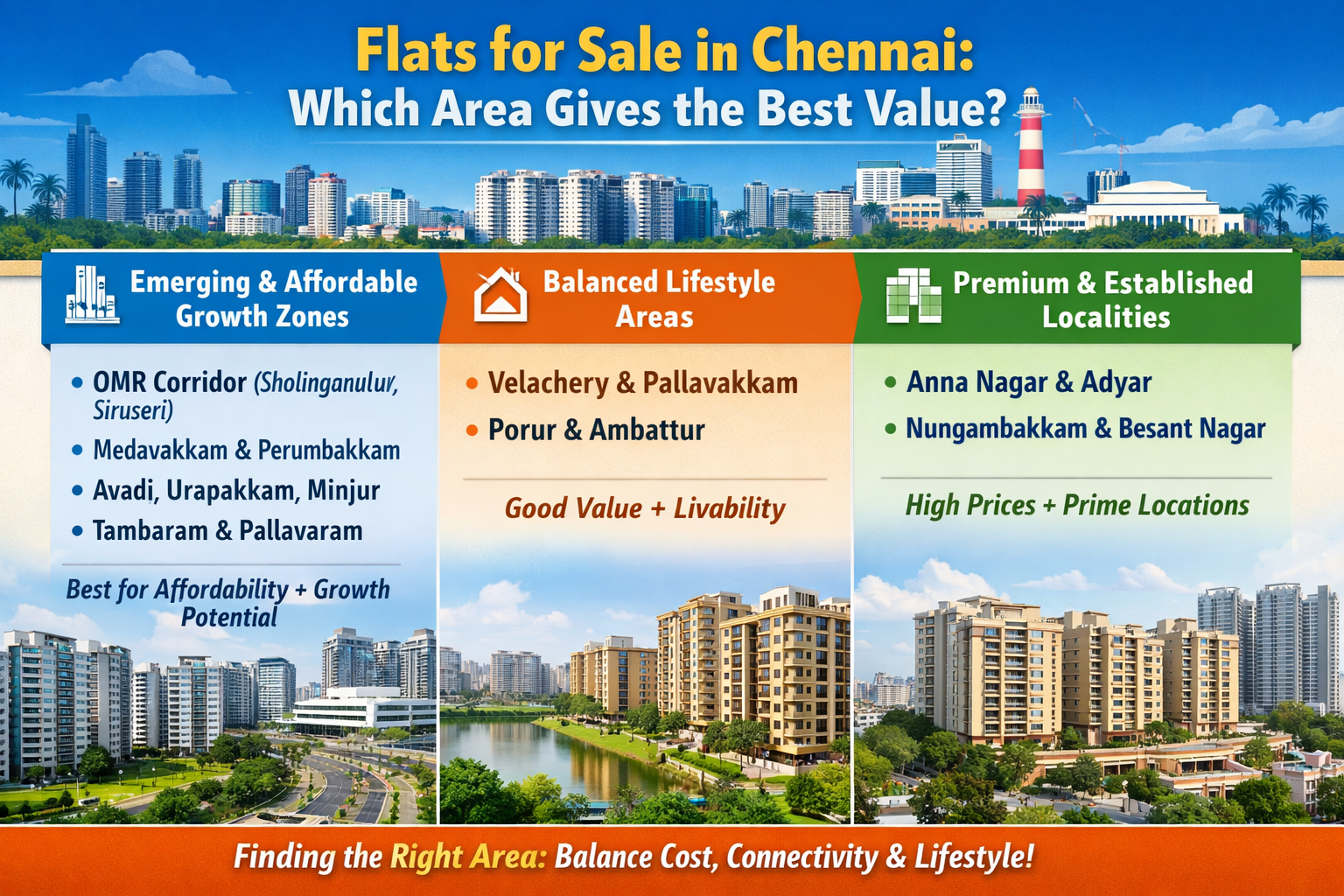

- Demand and Supply: The demand for builder floor apartments often hinges on the location. Prime areas with good infrastructure, proximity to business hubs, schools, hospitals, and transportation options tend to have high demand. Researching a location’s current and future growth prospects can help gauge the potential for price appreciation.

- Upcoming Developments: Cities or regions undergoing infrastructural development (new metro lines, highways, or commercial centers) usually offer strong investment opportunities. Properties near these developments often see appreciation in value over time.

2. Appreciation

- Property Value Growth: Builder floor apartments in good locations generally experience steady price appreciation. As demand for residential units in urban areas increases, these properties can see a rise in their market value. In areas with limited land for new constructions, builder floors may hold or increase their value more significantly compared to larger apartment complexes.

- Long-Term Growth: Unlike apartments in large complexes, builder floors usually offer more individuality and privacy, which is attractive to homebuyers, especially in metropolitan areas. As urban sprawl continues, demand for independent units in residential neighborhoods can lead to substantial price increases in the long run.

3. Rental Income

- Higher Rental Yield: Builder floors, due to their independent nature, may have higher rental yields compared to flats in large apartment complexes. This is because tenants are often willing to pay a premium for more space, privacy, and a quieter environment.

- Demand for Rental Property: In growing urban areas, professionals, students, or expatriates may prefer renting builder floor apartments because they often offer more privacy and flexibility compared to flats. The rental demand in prime locations can provide steady income for investors.

| "Best Builder Floor Aapartmnet in Chennai" |

4. Flexibility and Customization

- Customizable Space: One of the main advantages of investing in a builder floor apartment is the potential for customization. Investors can renovate and upgrade the property to make it more appealing to potential buyers or renters. This flexibility allows for value addition, which can further enhance rental returns or resale value.

- Independence from Society Regulations: Unlike apartments in a large complex, which may have strict society rules and maintenance charges, builder floor apartments are generally more flexible. The absence of society maintenance fees or shared facilities makes them more cost-effective in the long run.

5. Market Liquidity

- Easier Sale Process: In certain locations, builder floors are more desirable to buyers because they provide privacy and ownership of the land beneath the property. This can lead to quicker sales, especially in sought-after neighborhoods.

- Potential for Capital Gains: In certain cities, especially those where new developments are scarce or the property market is booming, builder floors are often seen as a better option for capital appreciation due to the scarcity of land. In contrast to high-rise apartments that are more common, a builder floor can command a higher resale value.

6. Risk Factors

- Location Risk: Not all builder floor apartments are in high-demand areas. If you invest in a location that doesn't experience growth or faces issues such as infrastructure delays or poor connectivity, the property’s value and rental income potential may suffer.

- Maintenance and Upkeep Costs: While there are fewer common areas to maintain in a builder floor, the upkeep of the property itself (roof, plumbing, etc.) may become the responsibility of the owner. This could lead to higher ongoing costs than living in a managed apartment complex.

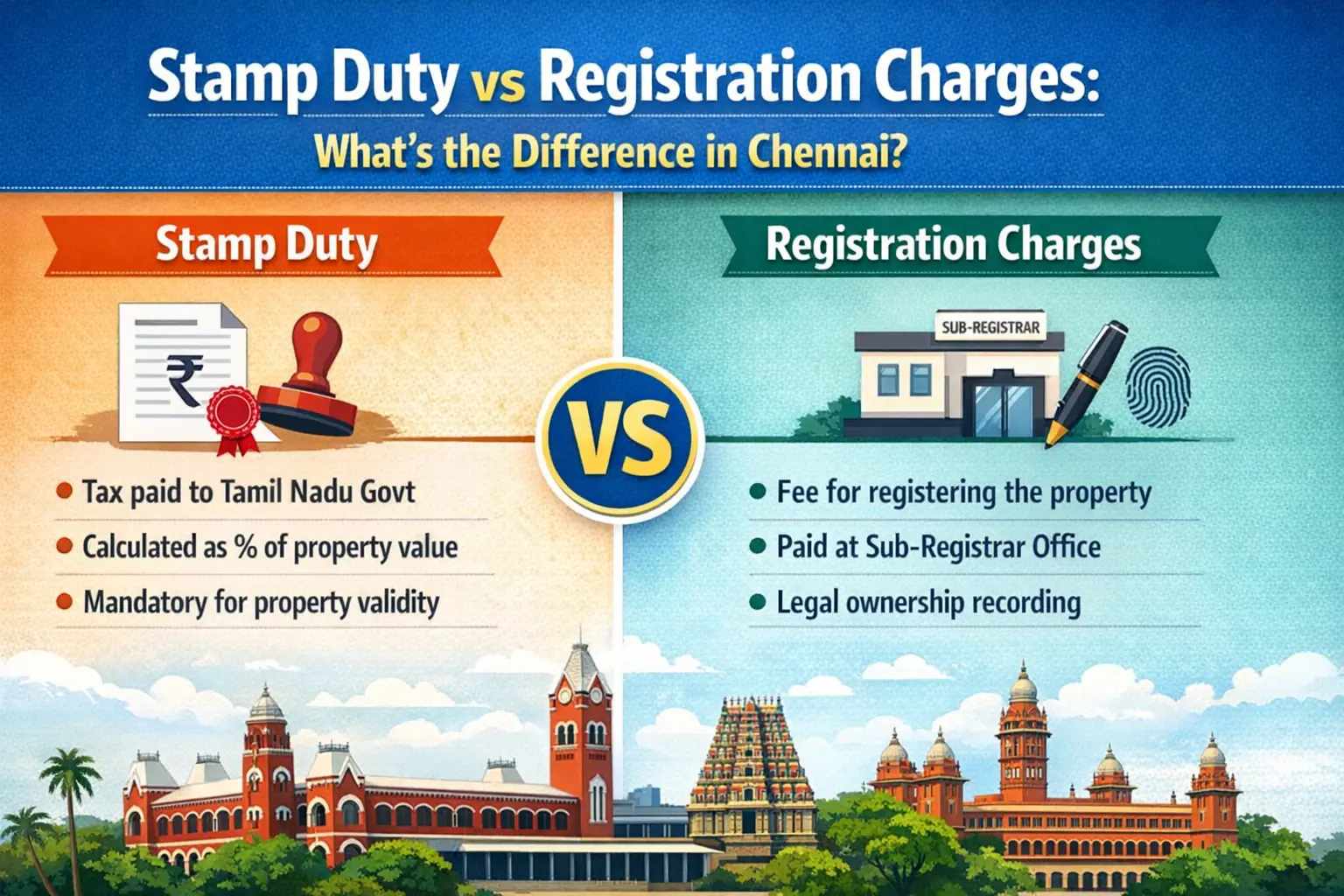

- Regulatory Risks: In some cities, builder floor apartments may not be as regulated as larger apartment complexes. It's important to verify the legality of the construction, the ownership of land, and any permissions required for future development or modifications.

- Market Fluctuations: Like all real estate, the market can fluctuate due to economic conditions, interest rates, or local market trends. During downturns, property values may not increase as anticipated, and rental yields could be impacted.

7. Financing and Loan Availability

- Loan Terms: Builder floors typically have lower prices compared to large apartment complexes, so financing may be easier. Banks and financial institutions tend to offer home loans for such properties, though the loan-to-value (LTV) ratio may vary depending on the property’s location and builder credentials.

- Depreciation Risk: If the property is not well maintained or becomes outdated, there’s a risk of depreciation, but this can often be mitigated with strategic renovations and improvements.

8. Comparing with Other Real Estate Investment Types

- Versus Flats in Apartment Complexes: Builder floors offer more privacy and better control over the property, whereas flats in large apartment complexes come with community amenities, security, and shared responsibilities. Builder floors often have a higher value due to their individuality and land ownership.

- Versus Villas or Independent Houses: While villas or independent houses may offer more space and luxury, builder floors tend to be a more affordable investment option in prime areas with similar benefits (privacy, autonomy, land ownership).

Investing in a builder floor apartment can be highly profitable, especially in the right location with strong demand for rentals or resale. The potential for long-term capital appreciation, higher rental yields, and the ability to customize the property are attractive factors. However, it’s essential to do thorough research on the location, property legalities, and market conditions before making an investment.

https://www.livehomes.in/blogs